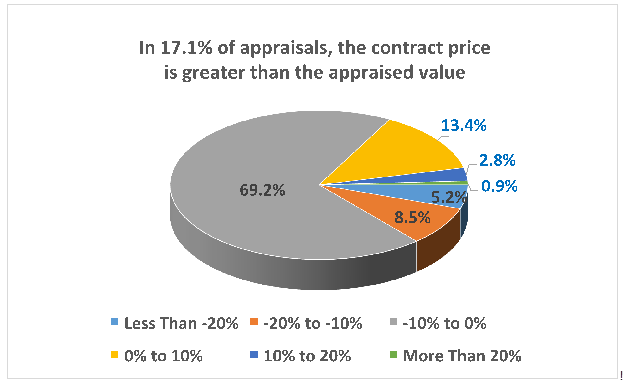

Study Finds More Than 17 Percent of Appraisals Report a Value Less Than Contract Price

More than 17 percent of appraisals on purchase transactions were found to report a value less than the value of the contract price. This is according to Platinum Data Solutions, a provider of collateral valuation and risk assessment technologies, which based this information on data collected from FreeAppraisalReview.com, an automated appraisal quality technology designed specifically for residential real estate appraisers.

According to Phil Huff, Platinum Data’s CEO, this data could indicate that home values have plateaued, or that appraisers are simply being more cautious when valuing properties.

“When one in five appraisals is lower than the contract price, it’s worth taking a deeper delve to find out what property values are doing,” Huff said. “For example, it could mean that buyers are paying more than a property is actually worth, possibly because the market is starting to stabilize. On the other hand, it could indicate that appraisers are being more conservative in valuing properties, which—given the regulations they’re facing—would be understandable.”

FreeAppraisalReview.com was launched in late September, but was in beta testing for several months prior. More than 5,000 appraisers have used FreeAppraisalReview.com since mid-September 2014.

Returned appraisals are the most frequent grievance among lenders and appraisers because they drain efficiency and reduce profitability. When lenders and AMCs catch errors, they return the report to the appraiser for corrections or clarifications. This can cause days-long delays, not to mention a reduction in profit margins for everyone involved: The appraiser, AMC and lender.

“Lenders and investors would be wise to keep their eyes on trends like this,” said Huff. “If frequent lower appraised values are reflective of a stabilizing or declining market, that could present a major impediment to the quality of loans they’re transacting, selling and buying.”