Permanent Loan Mods Hit 109,000 in Q3

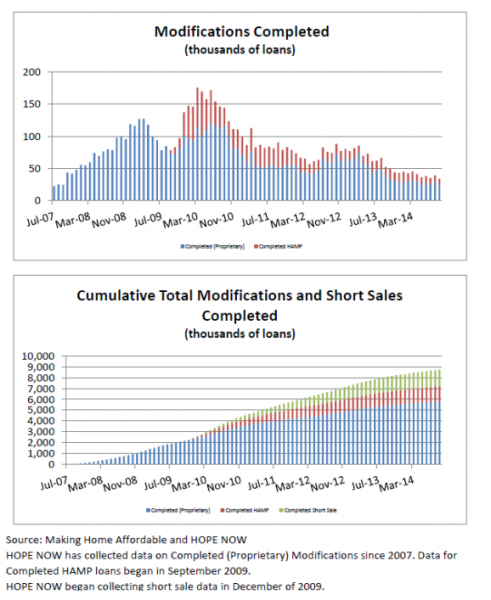

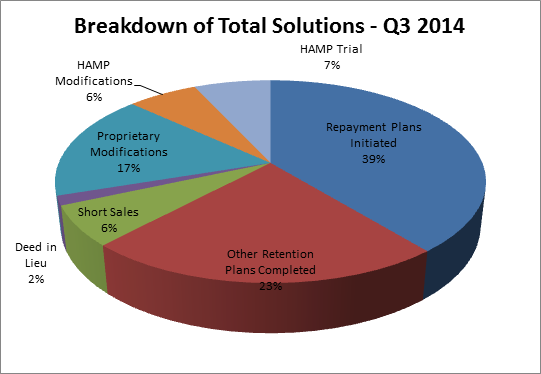

HOPE NOW has released its third quarter 2014 data, showing that approximately 468,000 homeowners received non-foreclosure solutions from mortgage servicers in July, August and September. Permanent loan modifications totaled approximately 109,000 and short sales totaled 30,000. Other solutions (including repayment plans, deeds in lieu, other retention plans and liquidation plans) made up the rest of the total number. When homeowners do not qualify for long term permanent loan modifications, mortgage servicers continue to look for short term options that, in many cases, lead to a permanent solution. Foreclosure sales totaled approximately 108,000 for the quarter. This is the lowest quarterly total for foreclosure sales recorded since HOPE NOW began tracking loan data in 2007.

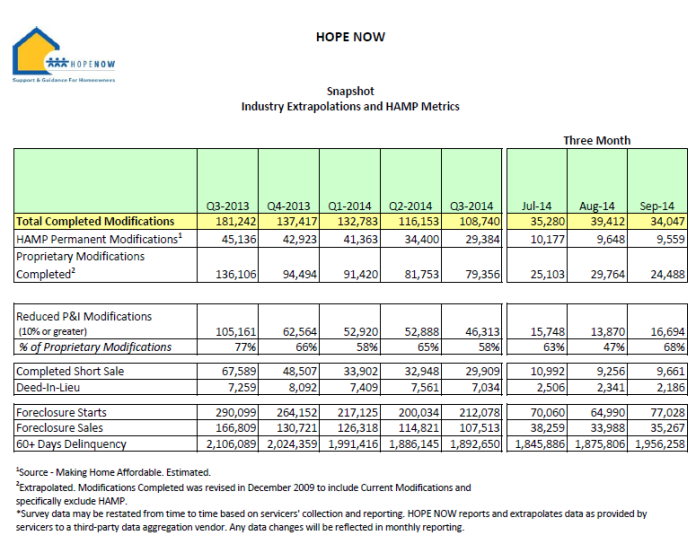

Of the 109,000 loan modifications completed for the third quarter of 2014, about 79,000 homeowners received proprietary loan modifications and 29,384 homeowners received loan modifications completed under the Home Affordable Modification Program (HAMP).

“While the third quarter did show declines across the board in mortgage solutions, it is important to note that foreclosure sales and serious delinquencies have declined accordingly," said Eric Selk, executive director of HOPE NOW. "The delinquency trends, quarter over quarter, show a steady improvement in the national market and point towards housing stabilization."

For Q3 2014, the combination of total loan modifications, short sales, deeds in lieu and workout plans outpaced foreclosure sales by a margin of more than four to one (approximately 468,000 solutions vs. 108,000 foreclosure sales).

During the third quarter of 2014, there were an estimated 108,000 foreclosure sales, compared to 115,000 during the previous quarter—a decline of over six percent. Foreclosure starts increased six percent, with approximately 212,000 reported for Q3 2014 vs. 200,000 reported for Q2 2014. Here are some other key metrics for Q3 2014 vs. Q2 2014:

During the third quarter of 2014, there were an estimated 108,000 foreclosure sales, compared to 115,000 during the previous quarter—a decline of over six percent. Foreclosure starts increased six percent, with approximately 212,000 reported for Q3 2014 vs. 200,000 reported for Q2 2014. Here are some other key metrics for Q3 2014 vs. Q2 2014:

►Loan modifications were approximately 109,000 for Q3 2014 vs. 116,000 in Q2 2014, a decline of approximately six percent.

►Short sales completed in the third quarter of 2014 were approximately 30,000 vs. 33,000 for the second quarter of 2014, a decline of nine percent.

The 108,000 foreclosure sales in the third quarter of 2014 compares to an estimated 166,000 completed during the third quarter of 2013.

Here are some other key metrics for Q3 2014 vs. Q3 2013:

►Total solutions for the third quarter were approximately 468,000 vs. 579,000 for the third quarter of 2013. This represented a decline of 19 percent.

►Loan mods for Q3 2014 were approximately 109,000 vs. 181,000 for Q3 2013—a decline of 40 percent.

►Foreclosure starts for the third quarter of 2014 were approximately 212,000 vs. 290,000 for the third quarter of 2013, a decline of 27 percent.

►Short sales completed for Q3 2014 were approximately 30,000 vs. 68,000 for Q3 2013—a decline of 56 percent.

►Deeds in lieu for Q3 2014 were approximately 7,000—a decline of four percent from Q3 2013 (7,300).

►Delinquencies of 60-plus days were approximately 1.89 million for Q3 2014, compared to 2.11 million for Q3 2013—a decline of 10 percent.

For the month of September, mortgage servicers offered approximately 150,000 total solutions. There were an estimated 34,000 permanent loan modifications completed. Of that total, approximately 24,000 were proprietary loan modifications and 9,559 were completed under HAMP. Total modifications for the month represented a 14 percent decrease from the previous month (39,000). Of the proprietary loan modifications completed in September 2014, approximately 68 percent (17,000) had reduced monthly principal and interest payments of more than 10 percent.

Other key metrics for the month of September 2014 compared to August 2014:

►Foreclosure sales were estimated at 35,000 in September vs. 34,000 in August—an increase of four percent.

►Foreclosure starts were estimated at 77,000 in September vs. 65,000 in August—an increase of 18 percent.

►Short sales completed were approximately 9,700 in September vs. 9,300 in August—an increase of four percent.