New Home Purchase Apps Down, Foreclosures on the Rise

November was an unhappy month in the 2014 housing calendar, according to a pair of new data reports released today. The Mortgage Bankers Association’s (MBA) Builder Application Survey data for November found mortgage applications for new home purchases dropped by 22 percent from one month earlier. The MBA estimated that new single-family home sales were at a seasonally adjusted annual rate of 401,000 units in November, compared to 461,000 in October.

However, the average loan size of new homes increased from $300,289 in October to $306,975 in November.

"Following strong new home sales in October, our data shows November sales volume dropped significantly,” said Mike Fratantoni, chief economist at the MBA. “Average loan size increased to almost $307,000 in November from roughly $300,000 in October, indicating that builders are having greater success with higher priced homes and difficulty at the entry level, as first-time buyers continued to face tight credit conditions."

By product type, conventional loans composed 69.3 percent of loan applications, with FHA loans a distant second place at 15.8 percent, followed by VA loans at 14 percent and RHS/USDA loans at 0.9 percent.

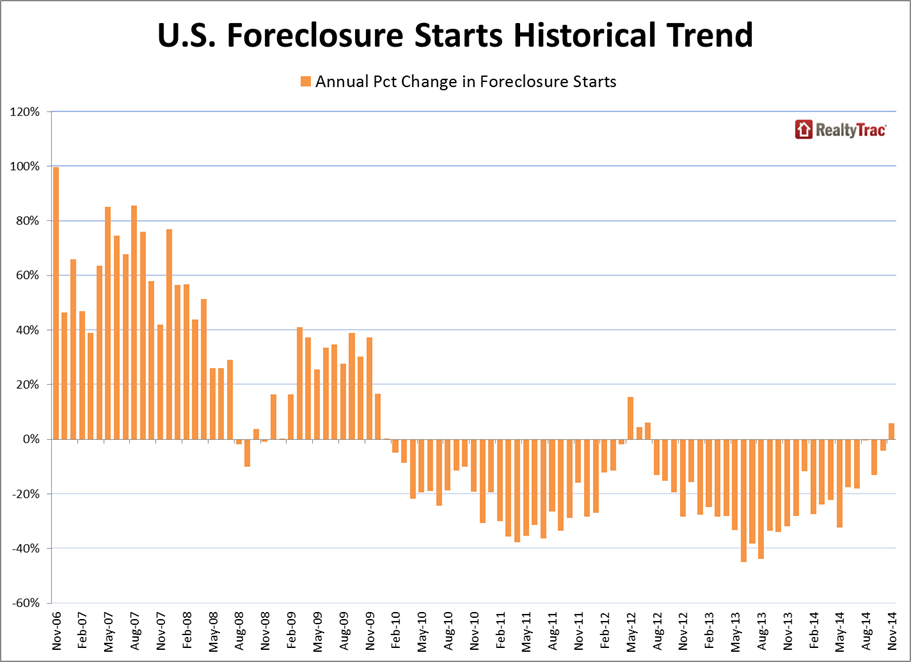

Separately, RealtyTrac’s U.S. Foreclosure Market Report for November found a total of 55,906 U.S. properties started the foreclosure process in November, a decrease of one percent from the previous month but a six percent increase from a year ago, the first year-over-year increase following 27 consecutive months of year-over-year decreases. The report also determined that 50,102 U.S. properties were scheduled for foreclosure auction during the month, down 16 percent from an 18-month high in the previous month but up five percent from a year ago.

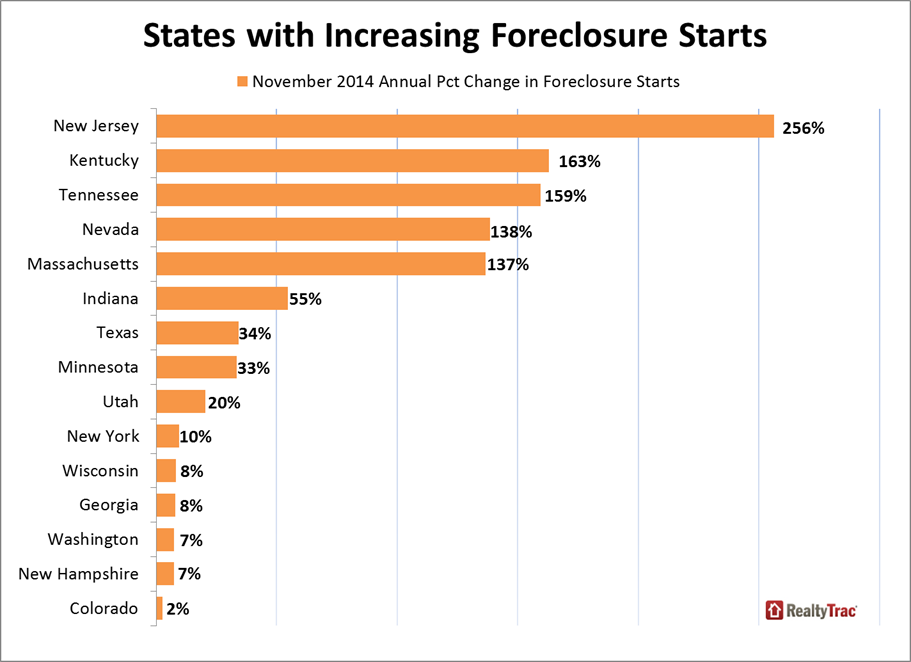

Scheduled foreclosure auctions increased from a year ago in 30 states, most notably in Kentucky (163 percent), Tennessee (159 percent), North Carolina (157 percent), New Jersey (117 percent) and Oregon (114 percent). Foreclosure starts, which in some states are the scheduled foreclosure auctions, increased from a year ago in 30 states, including New Jersey (256 percent), Nevada (138 percent) and Massachusetts (137 percent). REOs increased from a year ago in 15 states, including Maryland (93 percent), North Carolina (66 percent), New York (64 percent), Kentucky (56 percent) and New Jersey (54 percent).

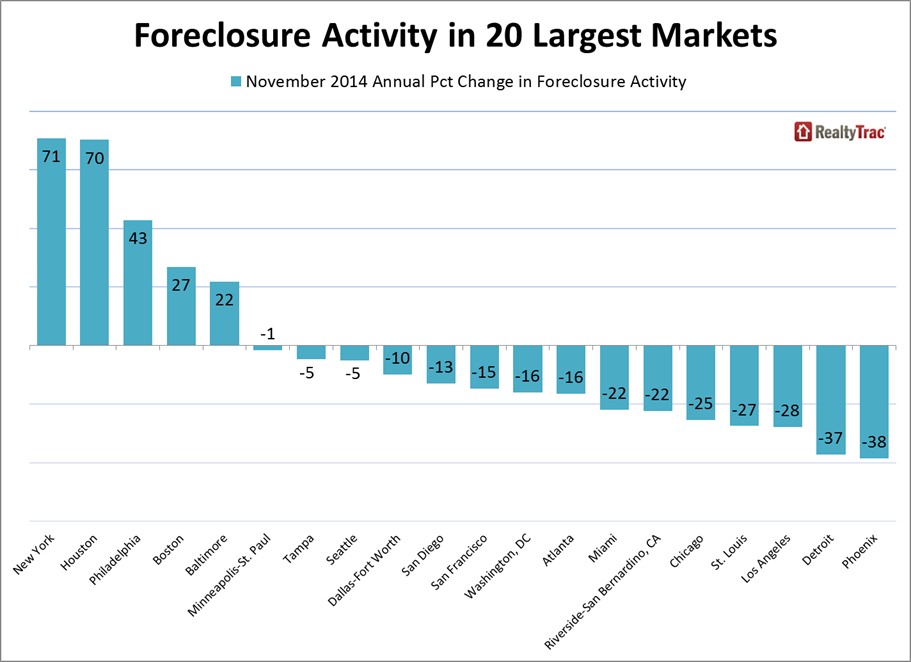

Furthermore, five of the nation’s 20 largest metro areas posted year-over-year increases in foreclosure activity: New York (71 percent), Houston (70 percent), Philadelphia (43 percent), Boston (27 percent) and Baltimore (22 percent). The ailing New Jersey resort Atlantic City, where one in every 289 housing units had a foreclosure filing in November, posted the highest foreclosure rate among metropolitan statistical areas with a population of 200,000 or more. Atlantic City REO activity increased 264 percent from a year ago, the 11th consecutive month of year-over-year increases in REO activity for the metro area.

Still, not all of the foreclosure data was gloomy. RealtyTrac determined that foreclosure filings were reported on 112,498 U.S. properties in November—or, one in every 1,170 U.S. housing units—a decrease of nine percent from the previous month and down one percent from a year ago. This marked the 50th consecutive month with a year-over-year decrease in overall foreclosure activity.

Lenders repossessed 25,249 properties in November, down 10 percent from the previous month and down 17 percent from a year ago, making November the 24th consecutive month with year-over-year decreases.

Daren Blomquist, vice president at RealtyTrac, detected some troubling aspects of recently originated mortgages in this new foreclosure data.

“Foreclosure rates on 2014-originated loans are actually higher than 2013-originated loans nationwide and in many markets, indicating that lenders are open to a slightly higher level of risk than we’ve seen over the past five years of extremely tight lending standards,” Blomquist said. “But it’s unlikely that lenders will dial up that risk level too quickly going forward given that many are still dealing with working through a lengthy and messy foreclosure process on risky loans from the last loose lending spree.”