HOPE NOW Reports 39,000 Permanent Loan Mods Granted in October

HOPE NOW has released its October 2014 loan modification data, finding that an estimated 39,000 homeowners received permanent, affordable loan modifications from mortgage servicers during the month. This total includes modifications completed under both proprietary programs and the government’s Home Affordable Modification Program (HAMP). HOPE NOW has also restated all data points for 2014. In October, data was received from an additional servicer going back to January. This will affect all previous data reports for 2014. As the industry has consolidated, thousands of loans have transferred between servicers, which has resulted in the need to capture data from the servicers who have taken over the servicing rights of these loans.

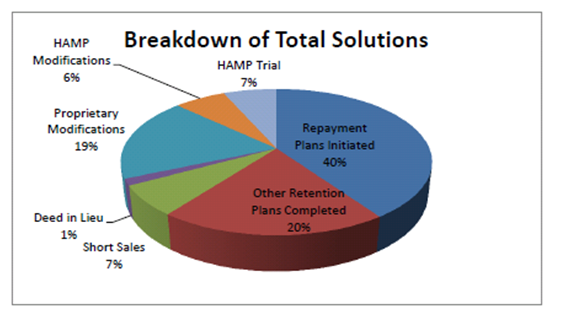

For the month of October, the combination of total loan modifications, short sales, deeds in lieu and workout plans were approximately 157,000. This compares to approximately 39,000 foreclosure sales for the month. Since the beginning of 2014, mortgage solutions continue to outpace foreclosure sales by a margin of four to one.

Of the permanent loan modifications completed in the month of October, an estimated 29,000 were through proprietary programs and 10,023 were completed via HAMP.

Foreclosure starts declined in October, with approximately 65,000 for the month, compared to 77,000 in September—a decrease of 15 percent. Completed foreclosure sales were up for the month, with approximately 39,000 reported in October compared to 35,000 reported in September—an increase of 10 percent. Both numbers represent modest declines from the same point in 2013. In October 2013, there were 101,000 foreclosure starts and 51,000 foreclosure sales reported.

Delinquencies of 60 days or more were under two million—at approximately 1.91 million. This represented a slight decrease (2.3 percent) from the previous month (1.96 million). Delinquency data is extrapolated from data received by the Mortgage Bankers Association (MBA) for the third quarter of 2014.

Other Key Metrics: October vs. September 2014

►Loan modifications: Approximately 39,000 completed in October vs. 34,000 in September—an increase of approximately 15 percent.

►Short sales: Approximately 10,400 completed in October vs. 9,700 in September—an increase of eight percent.

►Deed in-lieu: Approximately 2,300 completed in October vs. 2,200 in September—an increase of seven percent.