Fixed Rates Edge Higher to Close 2014

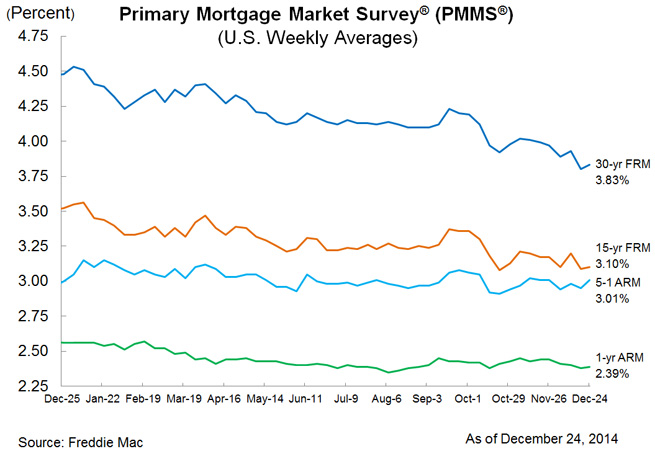

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates edging slightly higher, while remaining near their 2014 lows amid mixed housing and economic news. The 30-year fixed-rate mortgage (FRM) averaged 3.83 percent, with an average 0.6 point for the week ending Dec. 24, 2014, up from last week when it averaged 3.80 percent. A year ago at this time, the 30-year FRM averaged 4.48 percent. The 15-year FRM this week averaged 3.10 percent with an average 0.6 point, up from last week when it averaged 3.09 percent. A year ago at this time, the 15-year FRM averaged 3.52 percent.

"Mortgage rates were up slightly, following a week of mixed economic releases," said Frank Nothaft, vice president and chief economist, Freddie Mac. "Existing home sales were down 6.1 percent in November to annual rate of 4.93 million units, below economists' expectations. New home sales fell 1.6 percent last month to an annual rate of 438,000, also below expectations. Meanwhile, the third quarter real GDP was revised sharply higher to 5.0 percent according to the final estimate released by the Bureau of Economic Analysis."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.01 percent this week with an average 0.5 point, up from last week when it averaged 2.95 percent. A year ago, the five-year ARM averaged three percent. The one-year Treasury-indexed ARM averaged 2.39 percent this week with an average 0.4 point, up from last week when it averaged 2.38 percent. At this time last year, the one-year ARM averaged 2.56 percent.