Seven Million-Plus U.S. Residential Properties Remain Seriously Underwater

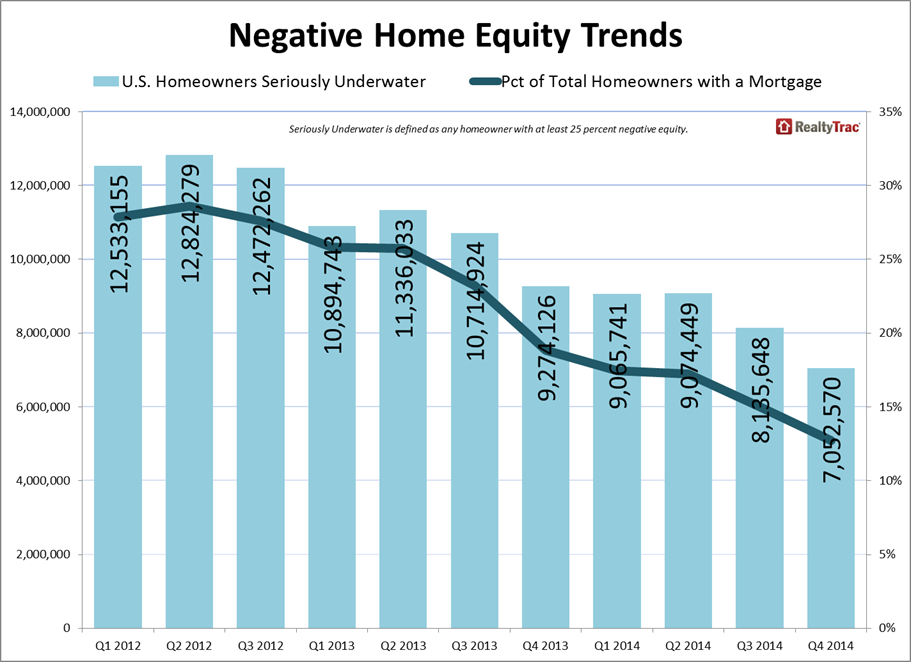

RealtyTrac has released its U.S. Home Equity & Underwater Report for the fourth quarter of 2014, which shows that at the end of the year there were 7,052,570 U.S. residential properties seriously underwater—where the combined loan amount secured by the property is at least 25 percent higher than the property’s estimated market value—representing 13 percent of all properties with a mortgage.

The number and share of seriously underwater homeowners at the end of the fourth quarter of 2014 were both at their lowest levels since RealtyTrac began tracking home equity trends in the first quarter of 2012 and are down from a peak of 12.8 million seriously underwater homeowners representing 29 percent of all homeowners with a mortgage in the second quarter of 2012.

“Median home prices nationwide bottomed out in March 2012 and since then have increased 35 percent, lifting 5.8 million homeowners out of seriously underwater territory,” said Daren Blomquist, vice president at RealtyTrac. “While the remaining seriously underwater properties continue to be a millstone around the neck of some local markets, the growing number of equity rich homeowners should help counteract the downward pull of negative equity in many markets, empowering those housing markets—and by extension their local economies—to walk on water in 2015.”

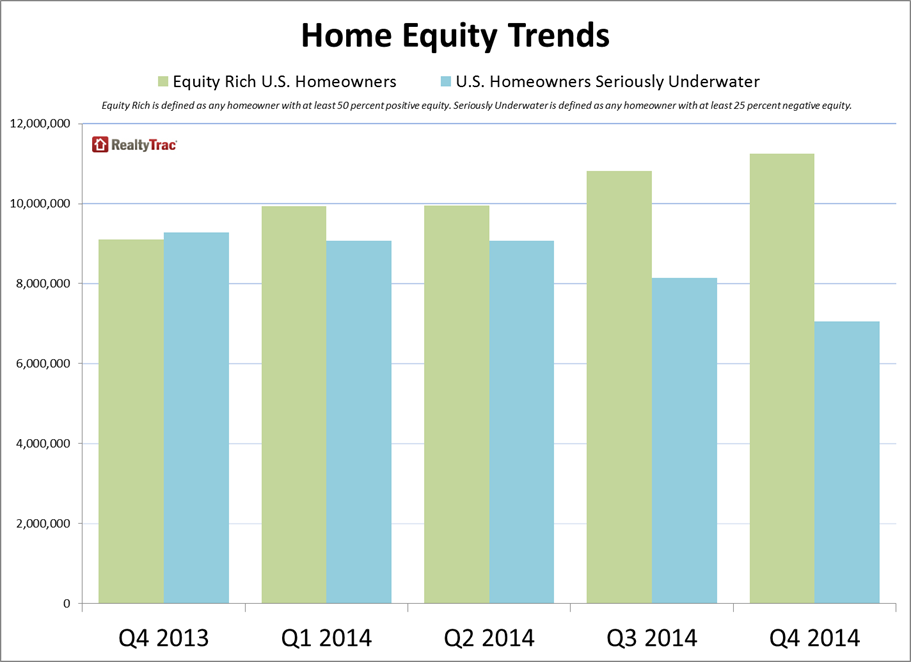

There were 11,249,646 equity rich U.S. residential properties with at least 50 percent positive equity at the end of 2014, representing 20 percent of all properties with a mortgage. That was up nearly 2.2 million from 9,097,325 equity rich properties at the end of 2013.

“With price escalation returning home values to near peak levels, homeowners who have positive equity have options before they face foreclosure,” said Chris Pollinger, senior vice president of sales at First Team Real Estate, covering the Southern California market, where six percent of residential properties with a mortgage were seriously underwater in the Los Angeles metro area at the end of 2014 compared to 32 percent that were equity rich.

Other major markets where the share of seriously underwater properties was below 10 percent at the end of 2014 included San Jose, Calif., (two percent), Denver (four percent), Portland (five percent), Minneapolis (five percent), Boston (five percent), San Francisco (five percent), Pittsburgh (six percent), Houston (eight percent), Dallas (eight percent) and Seattle (nine percent).

“I’m happy to report that the number of homeowners in the Seattle area who are underwater continues to decline and foreclosures are falling,” said OB Jacobi, president of Windermere Real Estate, covering theSeattle market. “Thanks to Seattle’s strong economy and thriving housing market, fourth quarter prices grew by more than 11 percent, enabling many homeowners to recover the equity they lost during the Great Recession.”

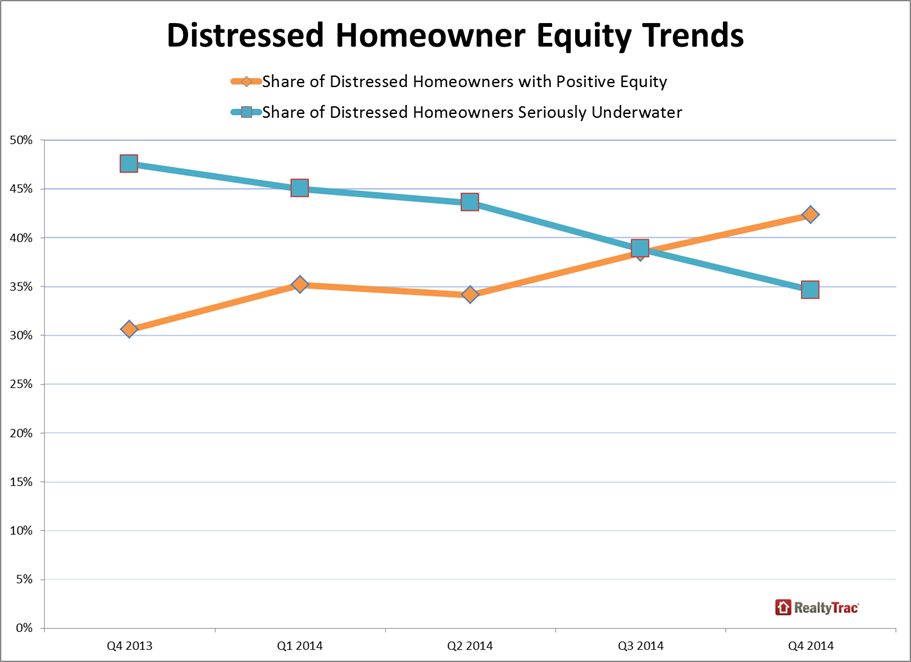

The share of distressed properties—those in some stage of foreclosure—with positive equity surpassed the share of distressed properties that were seriously underwater in the fourth quarter for the first time since RealtyTrac began tracking those metrics a year ago. At the end of the fourth quarter, 42 percent of distressed properties had some positive equity compared to 31 percent a year ago. Meanwhile 35 percent of distressed properties were seriously underwater at the end of the fourth quarter, compared to 48 percent a year ago.

“Over the last year and a half I have had more people come to me thinking they need a short sale only to be shocked by the current market value and the positive equity in their home,” said Frank Duran, broker at RE/MAX Alliance, covering the Westminster, Colo., market in the Denver metro area, where 81 percent of distressed homeowners had positive equity at the end of 2014—the highest percentage of any market nationwide—compared to nine percent of distressed homeowners seriously underwater. “We have certainly seen an upward turn in the market.”

Other major markets where the share of distressed properties with positive equity exceeded 60 percent included Pittsburgh (81 percent), Oklahoma City (76 percent), Austin, Texas (73 percent), Nashville (70 percent), San Antonio (63 percent), San Francisco (62 percent), and Raleigh, N.C. (61 percent).

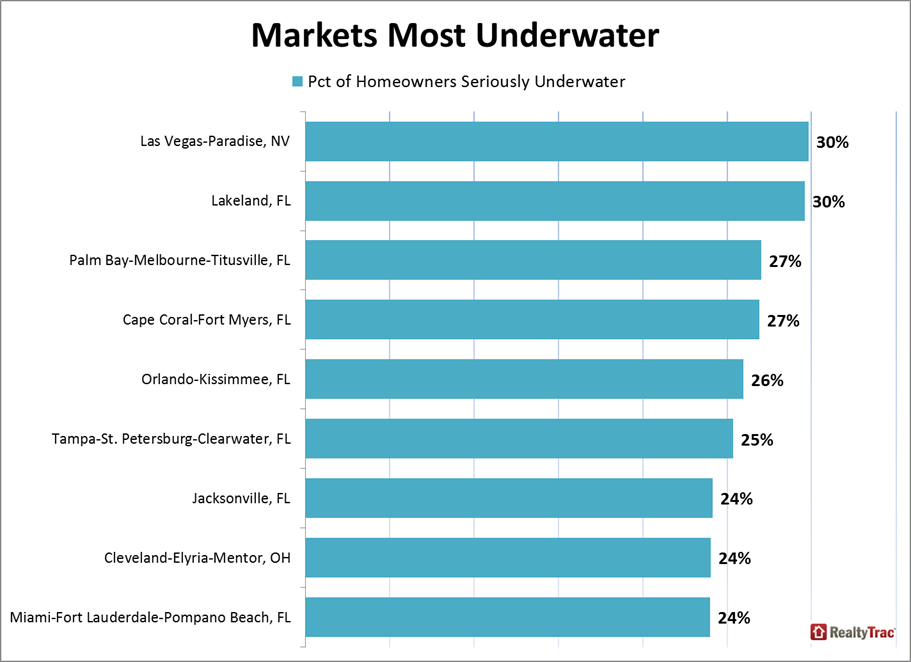

Markets with the highest percentage of seriously underwater properties as of the end of 2014 were Las Vegas (30 percent), Orlando (26 percent), Tampa (25 percent), Jacksonville, Fla., (24 percent), Cleveland (24 percent), Miami (24 percent), Detroit (24 percent), Chicago (22 percent) and Atlanta (19 percent).

Markets where the share of distressed properties that were seriously underwater exceeded 40 percent at the end of 2014 included Las Vegas (60 percent), Tampa (52 percent), Jacksonville, Fla., (50 percent), Orlando (49 percent), Chicago (48 percent), Detroit (47 percent), Miami (46 percent), and Cleveland (45 percent).

The percentage of loans seriously underwater were higher for loans originated during the housing bubble years of 2004 to 2008, with 36 percent of all loans originated in 2006 seriously underwater—the most of any loan vintage, followed by 2007 (32 percent), 2005 (28 percent), 2008 (22 percent), and 2004 (19 percent).