Home Prices, Loan Profits Register YoY Increases

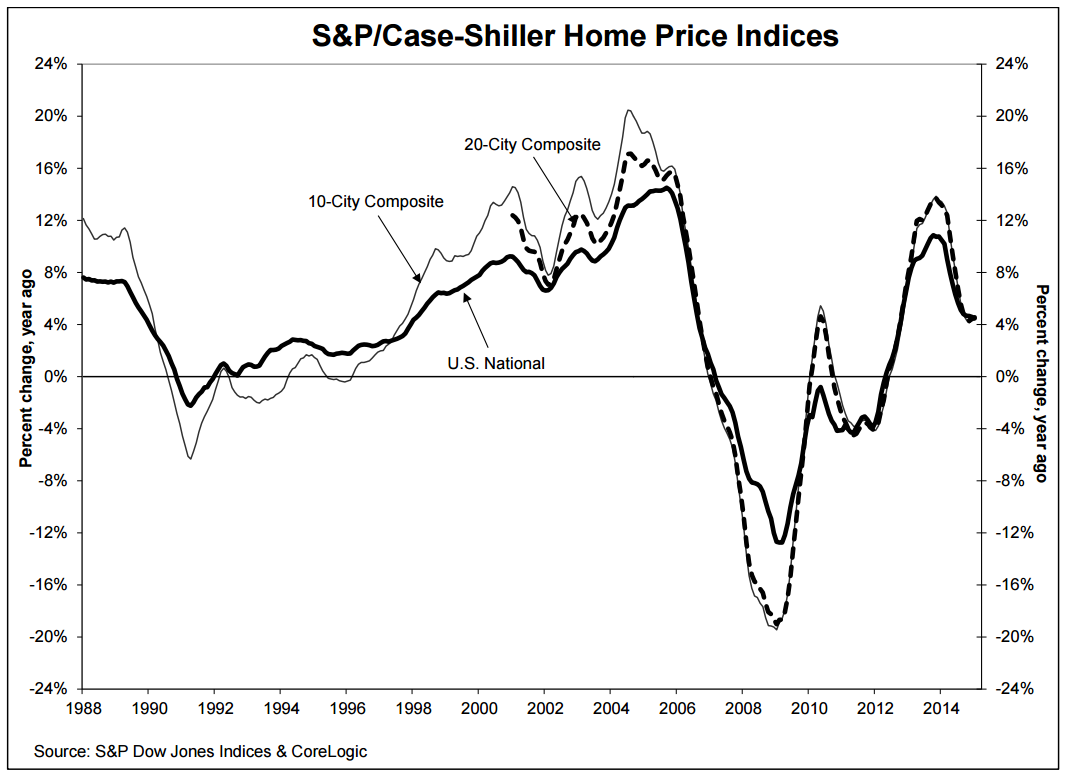

Home prices and loan production profits experienced year-over-year increases, according to the latest data from the S&P/Case-Shiller Home Price Indices and the Mortgage Bankers Association (MBA). However, home prices decreased on a month-over-month basis while mortgage banking profits fell on a quarter-by-quarter measurement.

The S&P/Case-Shiller numbers for January showed year-over-year increases in January compared to December for both the 10-City and 20-City Composites. The 10-City Composite gained 4.4 percent year-over-year, up from 4.3 percent in December, while the 20-City Composite gained 4.6 percent year-over-year, compared to a 4.4 percent increase in December. Denver and Miami reported the highest year-over-year gains—8.4 percent and 8.3 percent, respectively—over the last 12 months, while San Francisco registered the greatest decline in annual returns with a reported rate of 7.9 percent, down from 9.4 percent annually.

However, the S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.5 percent annual gain in January, slightly below the 4.6 percent increase in December. This is the fifth consecutive month-over-month decline for the National Home Price Index.

David M. Blitzer, managing director and chairman of the Index Committee for S&P Dow Jones Indices, warned that the housing market was still not on solid ground.

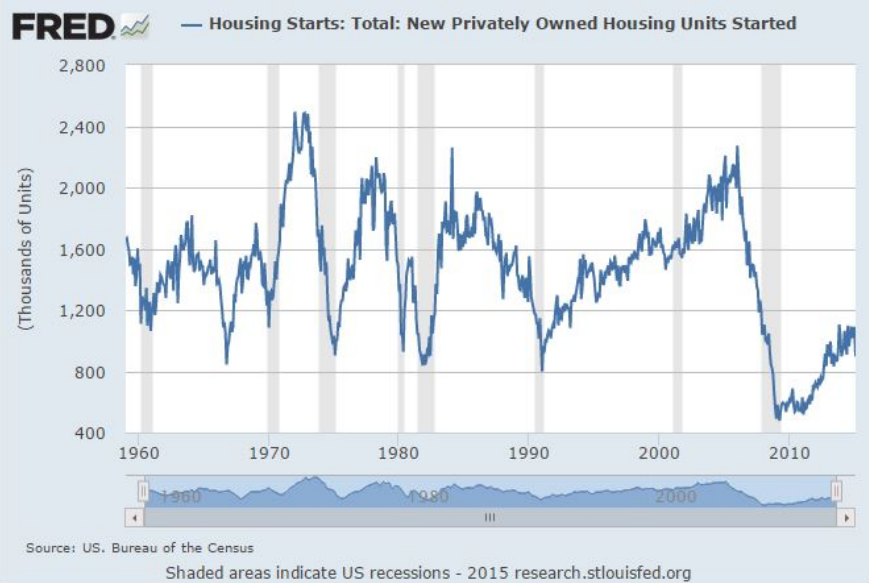

“Regional patterns in recent months continue: strength in the west and southwest paced by Denver and Dallas with results ahead of the national index in the California cities, the Pacific Northwest and Las Vegas,” Blitzer said. “The northeast and Midwest are mostly weaker than the national index. Despite price gains, the housing market faces some difficulties: Home prices are rising roughly twice as fast as wages, putting pressure on potential homebuyers and heightening the risk that any uptick in interest rates could be a major setback. Moreover, the new home sector is weak; residential construction is still below its pre-crisis peak. Any time before 2008 that housing starts were as low as the current rate of one million, the economy was in a recession.”

Separately, the MBA’s Quarterly Mortgage Bankers Performance Report found that independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $744 on each loan they originated in the fourth quarter of 2014, down from a reported gain of $897 per loan in the third quarter of 2014. But Marina Walsh, MBA’s vice president of industry analysis, pointed out that the year-over-year picture was considerably brighter.

“Production profits dropped slightly in the fourth quarter of 2014 compared to the third quarter of 2014,” Walsh said. “However, on a year-over-year basis, production profits were up. In the fourth quarter of 2014, profits were $744 per loan (32 basis points), compared to $150 per loan (nine basis points) in the fourth quarter of 2013. In addition, 74 percent of participating companies had overall positive pre-tax profits in the fourth quarter of 2014 compared to only 58 percent in the fourth quarter of 2013.”

The MBA also determined that the average production volume was $417 million per company in the fourth quarter of 2014, down from $437 million per company in the third quarter of 2014, but up from $367 million per company in the fourth quarter of 2013. The volume by count per company averaged 1,769 loans in the fourth quarter of 2014, down from 1,901 loans in the third quarter of 2014 but up from 1,641 loans in the fourth quarter of 2013.

The average loan balance for first mortgages grew to a study high of $233,655 in the fourth quarter of 2014, from $231,914 in the third quarter. But people were not looking for super-sized properties: the jumbo share of total first mortgage originations was 8.44 percent in the fourth quarter, compared to 9.42 percent in the third quarter.

Furthermore, the purchase share of total originations, by dollar volume, was 65 percent in the fourth quarter of 2014, compared to 72 percent in the third quarter of 2014. For the mortgage industry as a whole, MBA estimates the purchase share at 54 percent in the fourth quarter of 2014. And total loan production expenses—which include commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations—increased to $7,000 per loan in the fourth quarter of 2014, from $6,769 in the third quarter.