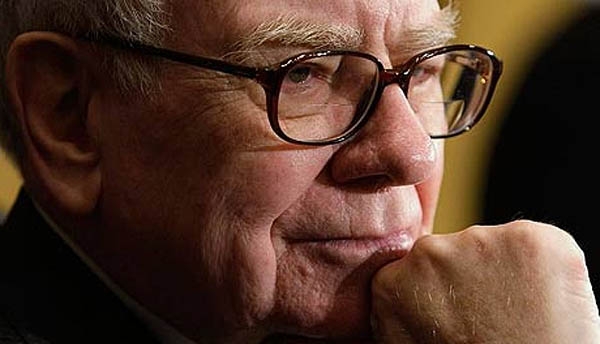

Warren Buffett: "I am Not a Predatory Lender"

One of the nation’s richest business executives has finally acknowledged month-old accusations that one of his companies has engaged in predatory lending practices against homeowners.

Last month, an investigative article by the Seattle Times and the Center for Public Integrity titled “The Mobile-Home Trap: How a Warren Buffett Empire Preys on the Poor” alleged that Buffett’s Clayton Homes Inc. charged too-high fees and pursued predatory collection and lending practices against its borrowers. Clayton Homes is involved in multiple aspects of manufactured housing, including construction, sales, financing, insurance and leasing.

The article’s authors said they sought input from Clayton Homes and its parent company, Berkshire Hathaway, but that spokeswomen for both companies “ignored more than a dozen requests by phone, e-mail and in person to discuss Clayton’s policies and treatment of consumers.” The Seattle Times added that after the article was published, “Berkshire Hathaway’s Omaha headquarters sent a statement on behalf of Clayton Homes to the Omaha World-Herald, which is also owned by Berkshire.”

The Wall Street Journal reported the Buffett finally began to publicly answer the charges against his company during Saturday’s annual Berkshire Hathaway shareholder meeting. When a shareholder raised the article’s charges during Saturday’s meeting adding that he was “disgusted” over the allegations leveled against the company, Buffett stood his ground.

“I make no apologies whatsoever for Clayton’s lending practices,” Mr. Buffett responded. “Clayton has behaved very well.”

Buffett added that only approximately three percent of Clayton’s $12 billion in mortgages failed, and that the company does not securitize its loans, thus increasing its own risk in the event of a borrower default.

“It’s true that manufactured housing hits the lower end of the market,” Buffett added. “The question is: Can you lend intelligently to people making those payments and keeping their house?”

But the story has yet to evaporate. Buffett was challenged about the charges against Clayton Homes this morning in an appearance on CNBC, and he again pushed back on the allegations, adding a personal spin to his defense.

"We are not forcing loans on anybody,” he insisted. “If they had a loan with us they didn't like, they can pass off and borrow from somebody else. We have 300,000 loans on the books and in the last three years I've not received one letter of complaint from anybody.”