National Credit Default Rate Hits All-Time Lows in April

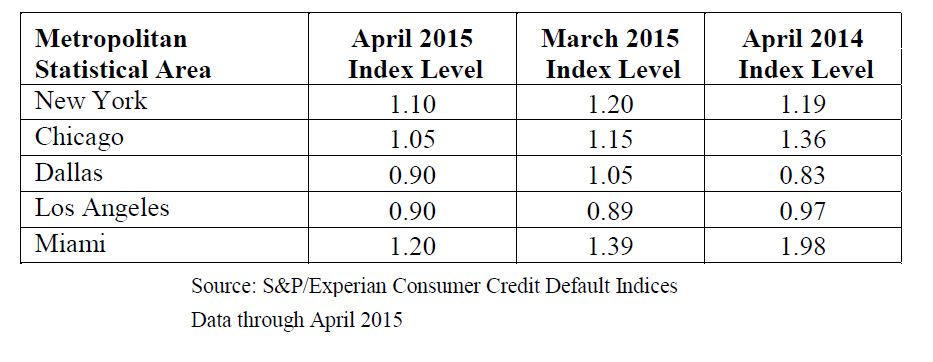

Data through April 2015, released by S&P Dow Jones Indices and Experian for the S&P/Experian Consumer Credit Default Indices, continued its downward trend in default rates. The composite index posted a historical low of 0.97 percent in April, a decrease of eight basis points, and its lowest level since July 2014. The second mortgage default rate also reported a historical low, down seven basis points to 0.43 percent. The auto loan default rate posted its second consecutive decrease with a reported rate of 0.94 percent, down nine basis points and its lowest level since June 2014.

The first mortgage default rate decreased for a third consecutive month, down nine basis points to 0.83 percent, its largest reported decrease since May 2014. The bank card default rate continued to rise, reporting a rate of 3.18 percent, an increase of 19 basis points and its highest reported rate since July 2013.

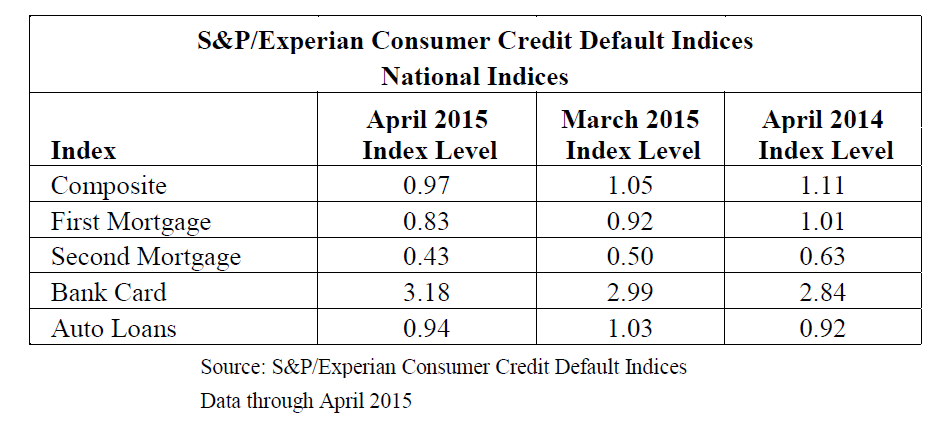

Four of the five major cities reported negative month over month default rate results in April. Miami led the way reporting a rate of 1.20 percent, down 19 basis points from the previous month. Dallas reported a second consecutive decrease, down 15 basis points to 0.90 percent. Chicago reported a default rate of 1.05 percent, a decrease of 10 basis points, its lowest reported rate since July 2006. New York posted its first decrease since November 2014 with a reported rate of 1.10 percent, down 10 basis points. Los Angeles reported the only rate increase, a modest one basis point increase to 0.90 percent.

“Continued improvements in the economy and the labor markets seen in the April unemployment rate and job growth suggest consumers have reasons to be optimistic,” said David M. Blitzer, managing director and chairman of the Index Committee for S&P Dow Jones Indices. “Apparently, that optimism has a darker side in rising defaults among bank card users. However, the current default rates are lower than those experienced before the financial crisis and should not present any significant economic concerns. Moreover, default experience in the mortgage series continues to impove. Overall, consumer credit conditions support further economic activity.”

The table below summarizes the April 2015 results for the S&P/Experian Credit Default Indices. These data are not seasonally adjusted and are not subject to revision.

“Among the cities, the notable trend is that the default rates for all five continue to move closer and closer together,” said Blitzer. “This is markedly different from the financial crisis when the default rates for Miami and Los Angeles were substantially higher than the other cities, especially compared to low rates in Dallas. City composite default rates are driven by first mortgage default rates and reflect the extent to which home prices fell after 2006. These patterns are another sign that housing is returning to more normal conditions.”

The table below provides the S&P/Experian Consumer Default Composite Indices for the five MSAs: