Home Sales Surge Force Fixed-Rates to 2015 High Point

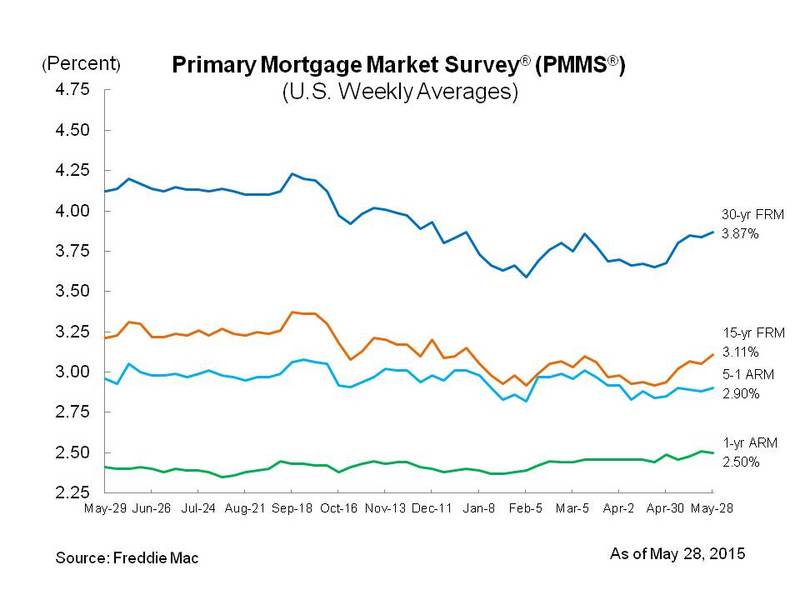

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that the average fixed-rate mortgage (FRM) moving higher amid positive housing data and pushing fixed mortgage rates to their highest level of the year, as the 30-year FRM averaged 3.87 percent with an average 0.6 point for the week ending May 28, 2015, up from last week when it averaged 3.84 percent. A year ago at this time, the 30-year FRM averaged 4.12 percent. The 15-year FRM averaged 3.11 percent this week with an average 0.5 point, up from last week when it averaged 3.05 percent. A year ago at this time, the 15-year FRM averaged 3.21 percent.

"Mortgage rates rose to the highest level in 2015 following positive housing market data," said Len Kiefer, deputy chief economist, Freddie Mac. "New home sales surged 6.8 percent to an annual pace of 517,000 units in April. Although existing home sales slipped 3.3 percent to a seasonally-adjusted pace of 5.04 million units, sales are up 6.1 percent on a year-over-year basis. The S&P/Case-Shiller 20-city home price index also posted a solid gain of five percent over the 12-months ending in March 2015."

Also this week, the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.90 percent with an average 0.5 point, up from last week when it averaged 2.88 percent. A year ago, the five-year ARM averaged 2.96 percent. The one-year Treasury-indexed ARM averaged 2.50 percent this week with an average 0.3 point, down from last week when it averaged 2.51 percent. At this time last year, the one-year ARM averaged 2.41 percent.