Distressed Properties Account for 12 Percent of March Home Sales

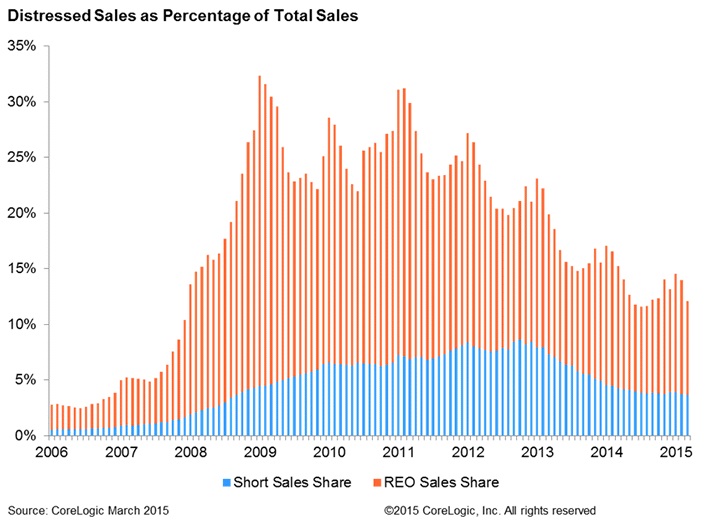

According to CoreLogic, distressed sales (real estate-owned (REO) and short sales) accounted for 12.1 percent of total home sales nationally in March 2015, a 3.2 percentage point drop from March 2014 and a 1.9 percentage point decrease from February 2015. Distressed sales shares typically decrease month over month in March due to seasonal factors, and this distressed sales share was the lowest for the month of March since 2007.

Within the distressed category, REO sales accounted for 8.4 percent of total home sales in March and short sales made up 3.7 percent. At its peak, distressed sales totaled 32.4 percent of all sales in January 2009, with REO sales representing 27.9 percent of that share. The ongoing shift away from REO sales is a driver of improving home prices since bank-owned properties typically sell at a larger discount than short sales. There will always be some amount of distress in the housing market, and by comparison, the pre-crisis share of distressed sales was traditionally about two percent. If the current year-over-year decrease in distressed sales share is maintained, the distressed sales share would reach that "normal" 2-percent mark in mid-2017.

Michigan had the largest share of distressed sales of any state at 22.1 percent in March 2015, followed by Florida (22 percent), Illinois (20.1 percent), Maryland (19.5 percent) and Connecticut (19.1 percent). Nevada had an 8 percentage point drop in its distressed sales share from a year earlier, the largest decline of any state. California had the largest improvement of any state from its peak distressed sales share, falling 57.6 percentage points from its January 2009 peak of 67.5 percent. While some states stand out as having high distressed sales shares, only North Dakota and the District of Columbia are even close to their pre-crisis numbers (within one percentage point).

Of the 25 largest Core Based Statistical Areas (CBSAs) based on loan count, Orlando-Kissimmee-Sanford, Fla. had the largest share of distressed sales at 24.6 percent, followed by Miami-Miami Beach-Kendall, Fla. (24.2 percent); Tampa-St. Petersburg-Clearwater, Fla. (23.5 percent); Chicago-Naperville-Arlington Heights, Ill. (22.9 percent); and Baltimore-Columbia-Towson, Md. (19.2 percent). Atlanta-Sandy Springs-Roswell, Ga. had the largest year-over-year drop in its distressed share, falling by 8.8 percentage points from 24.5 percent in March 2014 to 15.7 percent in March 2015. The CBSA with the largest overall improvement in its distressed sales share from its peak value was Riverside-San Bernardino-Ontario, Calif. At its peak in February 2009, distressed sales made up 76.3 percent of all sales in Riverside compared to the March 2015 share of 12.9 percent.