New Data Finds Good News for at-Risk Homeowners

A pair of new data reports offers an encouraging portrait of the nation’s at-risk homeowners, with significant drops in foreclosure levels and more activity in home retention solutions.

CoreLogic’s National Foreclosure Report for April found foreclosure inventory down by 24.9 percent and completed foreclosures down by 19.8 percent on a year-over-year basis. April saw 40,000 completed foreclosures nationwide, compared to 50,000 from one year earlier, and April’s level was a 65.8 percent plummet from the peak of completed foreclosures in September 2010.

CoreLogic added that the national foreclosure inventory included approximately 521,000 homes, or 1.4 percent, of all homes with a mortgage compared with 694,000 homes in April, down from the 1.8 percent level in April 2014. CoreLogic also determined that the number of mortgages in serious delinquency–defined as 90 days or more past due, including those loans in foreclosure or REO–fell on a year-over-year basis by 22.1 percent in April, with 1.4 million mortgages, or 3.6 percent, in this category; on a month-over-month basis, the number of seriously delinquent mortgages declined by three percent. This is the lowest serious delinquency rate since February 2008.

Still, the company insisted that this aspect of the housing crisis is not ready for the history books.

“Despite a slow and steady improvement in most housing market fundamentals, too many families remain in default of their mortgage obligations,” said Anand Nallathambi, president and CEO of CoreLogic. “The percent of homeowners with a mortgage that have missed three-or-more monthly payments or are in foreclosure proceedings dropped to 3.6 percent in our April data; while well below the record peak of nearly nine percent and the lowest in more than seven years, it remains about double the pre-2007 rate.”

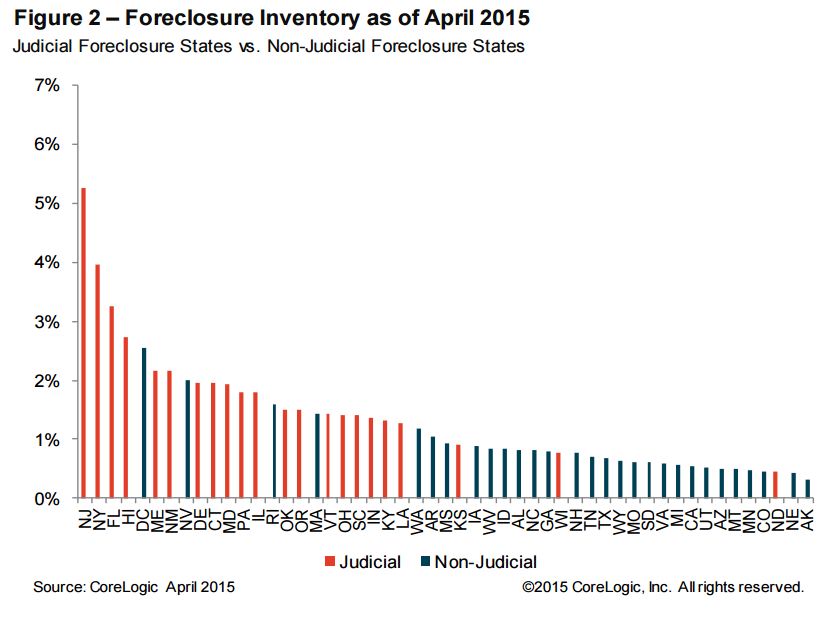

The five states with the highest number of completed foreclosures for the 12 months ending in April were Florida (106,000), Michigan (49,000), Texas (33,000), Ohio (28,000) and Georgia (27,000). CoreLogic added that these five states accounted for almost half of all completed foreclosures nationally.

Separately, the latest Mortgage Monitor Report issued by the Data and Analytics division of Black Knight Financial Services (BKFS) examined home retention actions–loan modifications and repayment plans–and found that of the approximately 952,000 borrowers who are 90 or more days past due but not yet in foreclosure, 62 percent have been through some form of home retention program.

According to BKFS data, some 53 percent of loans in active foreclosure had taken part in home retention initiatives. On a market-by-market level, Washington, D.C., led the nation with 67 percent of its Seriously delinquent inventory having gone through some sort of home retention activity–and out of that number, 26 percent are currently in an active trial modification or repayment plan. Maryland, Georgia, Texas and Connecticut followed, all having seen 66 percent of their 90-plus day delinquent inventory participate in some form of home retention action. However, three states–Florida, New York and New Jersey–made up 28 percent of the nation’s remaining 90-plus-day delinquent and foreclosure inventory.

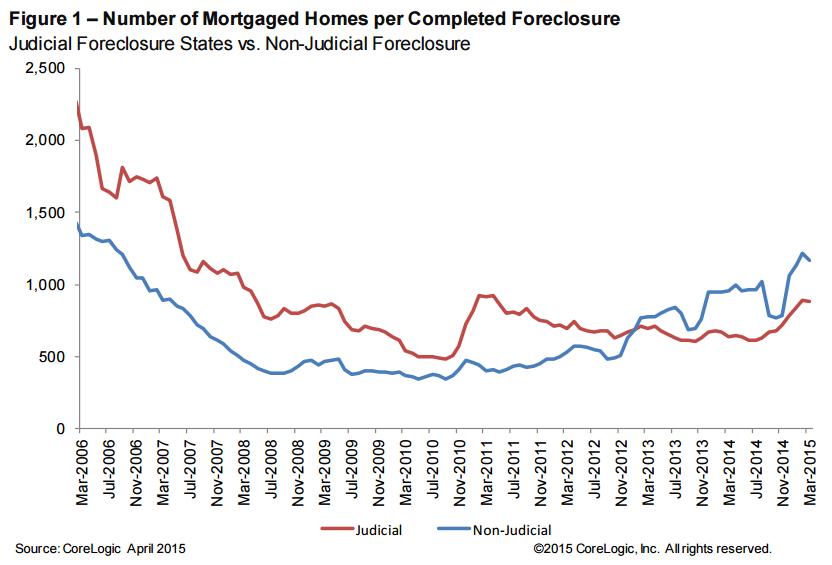

“Of these three states, Florida has seen the most improvement, with a 37 percent decline in inventory over the last year, and a 63 percent drop over the last two years,” said Black Knight Data & Analytics Senior Vice President Ben Graboske. “On the other hand, low foreclosure completion rates in New York and New Jersey have contributed to lingering inventory in those states. Looking at pipeline ratios–the length of time it would take to work through the backlog at the current rate of foreclosure completions–we see New York and New Jersey with nearly 13 and nine years of inventory, respectively. Even though Florida peaked with 20 percent of the entire state being 90 or more days past due, its pipeline ratio was never longer than 10 years and is currently the lowest among all the judicial foreclosure states at just under three years. Compare that to Washington, D.C., which uses a non-judicial foreclosure process and a comparatively very small backlog inventory, yet still has a pipeline of over 43 years, primarily due to extremely low foreclosure sales volume there.”