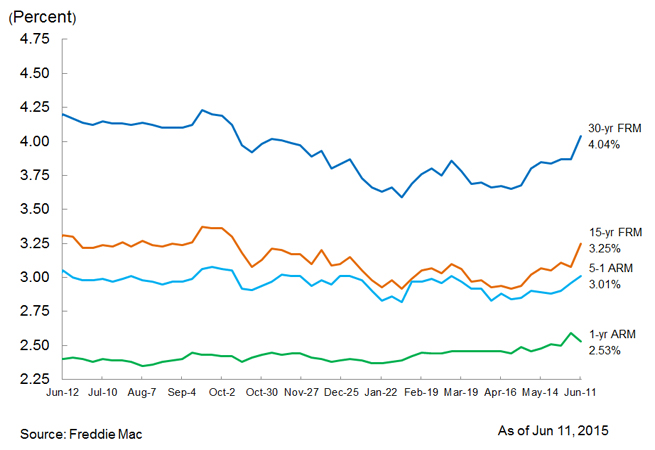

Mortgage Rates Hit Seven-Month High

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates reaching new highs for 2015 with the average 30-year fixed-rate mortgage (FRM) above four percent for the first time since Nov. 6, 2014 when it averaged 4.02 percent. This week, the 30-year FRM averaged 4.04 percent with an average 0.6 point for the week ending June 11, 2015, up from last week when it averaged 3.87 percent. A year ago at this time, the 30-year FRM averaged 4.20 percent. Also this week, the 15-year FRM averaged 3.25 percent with an average 0.6 point, up from last week when it averaged 3.08 percent. A year ago at this time, the 15-year FRM averaged 3.31 percent.

"Mortgage rates rose above four percent for the first time since November 2014 as Treasury yields surged," said Len Kiefer, deputy chief economist, Freddie Mac. "Markets are responding to strong employment data. In May, the U.S. economy added 280,000 jobs. Moreover, job openings surged to 5.4 million in April, up over 20 percent from a year ago."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.01 percent this week with an average 0.4 point, up from last week when it averaged 2.96 percent. A year ago, the five-year ARM averaged 3.05 percent. Also this week, the one-year Treasury-indexed ARM averaged 2.53 percent this week with an average 0.2 point, down from last week when it averaged 2.59 percent. At this time last year, the one-year ARM averaged 2.40 percent.