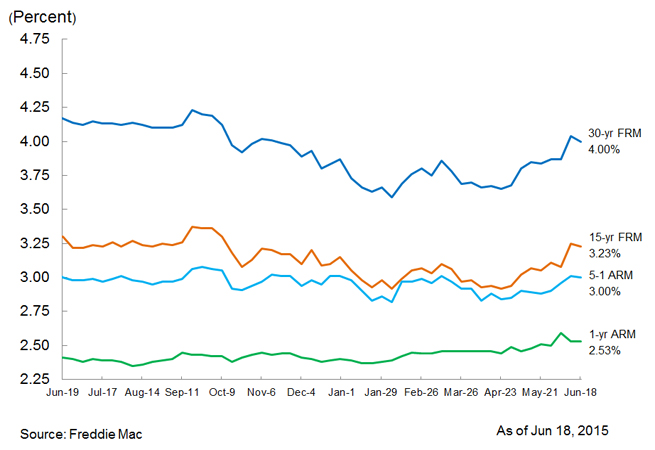

Fixed-Rates Dip Slightly, Still Hover at Four Percent Mark

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates moving lower from the previous week's new highs for 2015, while housing data was generally positive. The 30-year fixed-rate mortgage (FRM) averaged 4.00 percent with an average 0.7 point for the week ending June 18, 2015, down from last week when it averaged 4.04 percent. A year ago at this time, the 30-year FRM averaged 4.17 percent. The 15-year FRM this week averaged 3.23 percent with an average 0.5 point, down from last week when it averaged 3.25 percent. A year ago at this time, the 15-year FRM averaged 3.30 percent.

"Mortgage rates were down this week while housing data were generally positive," said Len Kiefer, deputy chief economist for Freddie Mac. "Although housing startsdropped 11.1 percent to a seasonally adjusted pace of 1.04 million units in May, housing permits surged 11.8 percent to its highest level since August 2007. Reinforcing this positive momentum, the NAHB housing marketindex rose 5 points in June, suggesting home builders are very optimistic about home sales in the near future."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged three percent this week with an average 0.4 point, down from last week when it averaged 3.01 percent. A year ago, the five-year ARM averaged three percent. The one-year Treasury-indexed ARM averaged 2.53 percent this week with an average 0.2 point, unchanged from last week. At this time last year, the one-year ARM averaged 2.41 percent.