FHFA: Q1 Foreclosure Prevention Actions Near 3.5 Million

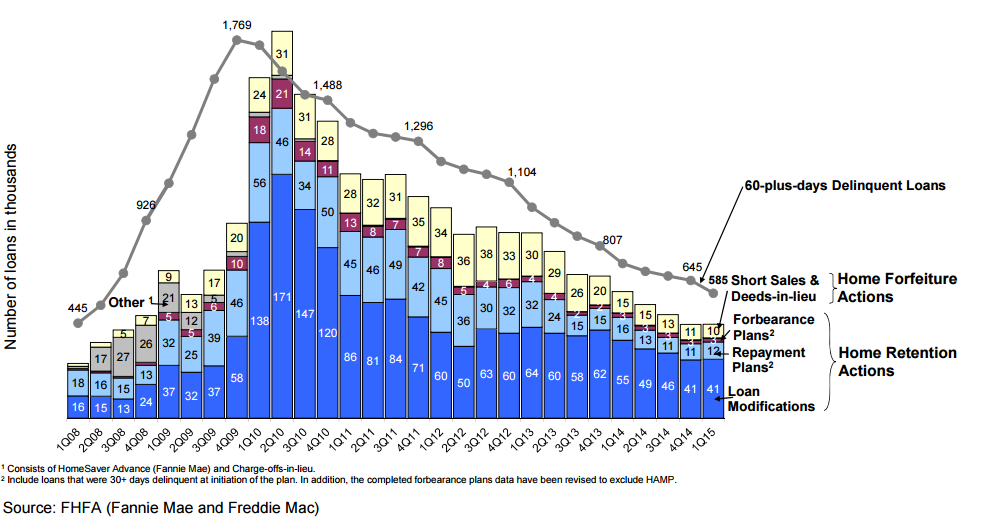

The Federal Housing Finance Agency (FHFA) has reported that Fannie Mae and Freddie Mac completed 65,960 foreclosure prevention actions in the first quarter of 2015, bringing the total foreclosure prevention actions to nearly 3.5 million since the start of the conservatorships in September 2008. These measures have helped nearly 2.9 million borrowers stay in their homes, including 1.8 million who received permanent loan modifications.

Other foreclosure prevention data for Fannie Mae and Freddie Mac noted in the quarterly report include:

►Approximately 31 percent of all permanent loan modifications in the first quarter helped to reduce homeowners’ monthly payments by over 30 percent.

►The number of 60-plus day delinquent loans declined another nine percent during the quarter.

►The serious delinquency rate of Fannie Mae and Freddie Mac loans fell to 1.8 percent at the end of the first quarter.

►The REO inventory of Fannie Mae and Freddie Mac declined 10 percent during the first quarter to 100,279 as property dispositions continued to outpace property acquisitions.