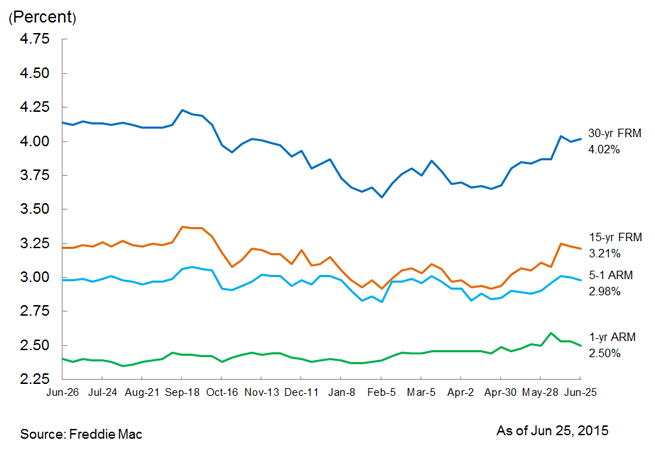

Fixed-Rate Mortgages Remain Around Four Percent Mark

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing the average fixed-rate mortgage (FRM) changing very little from the previous week amid reports of the U.S. housing market strengthening. The 30-year FRM averaged 4.02 percent with an average 0.7 point for the week ending June 25, 2015, up from last week when it averaged four percent. A year ago at this time, the 30-year FRM averaged 4.14 percent. The 15-year FRM this week averaged 3.21 percent with an average 0.6 point, down from last week when it averaged 3.23 percent. A year ago at this time, the 15-year FRM averaged 3.22 percent.

"Mortgage rates were little changed this week," said Sean Becketti, chief economist, Freddie Mac. "The rate on 30-year fixed-rate mortgages was 4.02 percent, an increase of just two basis points from the previous week. Economic releases confirmed increasing strength in housing. Existing home sales increased 5.1 percent in May to an annual pace of 5.35 million units and new home sales increased 2.2 percent to an annual pace of 546,000 units. Buyers appear anxious to purchase homes before the expected increase in interest rates later this year. Given the tight inventory of homes for sale, a 5.1-month supply at the current sales pace, home prices are being bid up."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.98 percent this week with an average 0.4 point, down from last week when it averaged three percent. A year ago, the five-year ARM averaged 2.98 percent. The one-year Treasury-indexed ARM averaged 2.50 percent this week with an average 0.3 point, down from last week when it averaged 2.53 percent. At this time last year, the one-year ARM averaged 2.40 percent.