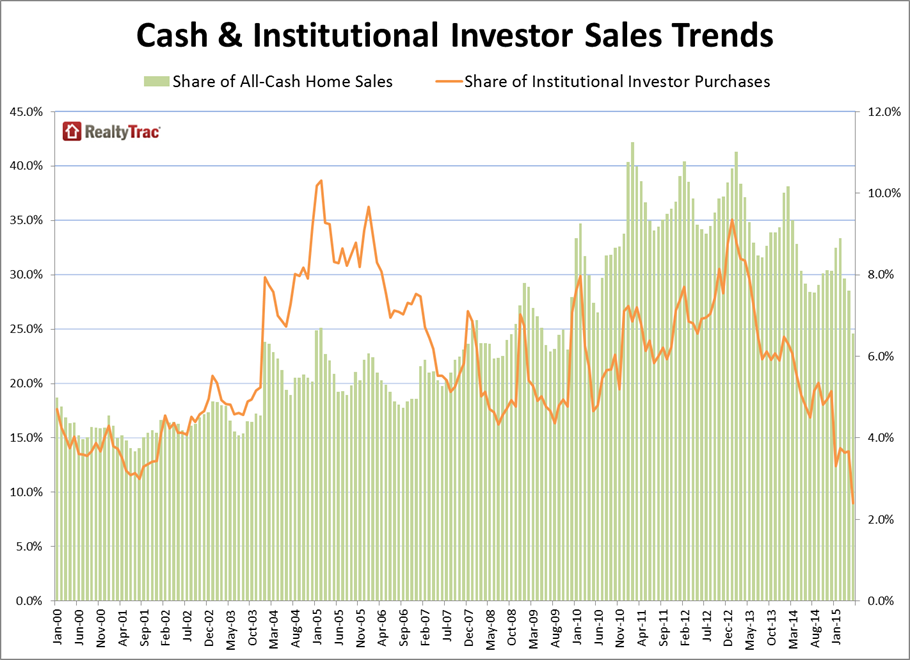

Share of All-Cash Home Sales Drops to Near-Six-Year Low

RealtyTrac has released its May 2015 U.S. Home & Foreclosure Sales Report, which shows 24.6 percent of all single family home and condo sales in May were all-cash purchases, down from 28.5 percent in the previous month and down from 30.4 percent a year ago to the lowest level since November 2009. The cash sales share in May was close to its long-term average going back to January 2000 of 24.8 percent and well below its recent peak of 42.2 percent in February 2011. The share of institutional investors—entities purchasing at least 10 properties in a calendar month—dropped to 2.4 percent of single family home sales in May, a record low going back to January 2000, the earliest month with data available.

“For the potential first-time homebuyer or move up buyer this is a good time to move ahead,” said Craig King, COO at Chase International brokerage, covering the Lake Tahoe and Reno, Nevada, markets. “Interest rates remain historically low, and the outlook for price appreciation is great. The competition in the market place is also different. While inventory is tight many investors have dropped out of the market and cash deals are not as prevalent as they were. Even in multi-offer situations much has been equalized. This is great news for first-time buyers.“

The median sales price of residential properties—including both distressed and non-distressed properties—that sold in May was $173,900, up four percent from the previous month but down one percent from a year ago. May was the second consecutive month where median sales prices nationwide were down on a year-over-year basis following 36 consecutive months of year-over-year increases.

“Distressed sales in May represented a significantly smaller share of a growing home sales pie as an increasing number of non-distressed sellers continued to cash out on the equity they’ve gained over the last three years of rising home prices,” said Daren Blomquist, vice president at RealtyTrac. “But those distressed sales are still acting as a drag on home prices, selling at a median price that is 43 percent below the median price of a non-distressed sale—the biggest gap we’ve seen since we began tracking that distressed discount in January 2006. As housing transitions from an investor-driven, cash-is-king market to one more dependent on traditional buyers, sales volume has been increasing over the last few months and is on track in 2015 to hit the highest level we’ve seen since 2006. And while sellers this spring are realizing the biggest average equity gains since 2006, home price appreciation is softening as the supply-and-demand balances tip more in favor of buyers and as banks began to clear out some of their more highly distressed foreclosures that sell at scratch-and-dent prices.”

The median sales price of non-distressed residential properties that sold in May was $205,000, up six percent from the previous month and up 9 percent from a year ago. May was the 37th consecutive month where non-distressed median home prices have increased on a year-over-year basis.

Meanwhile, the median sales price of distressed residential properties—those that were in some stage of foreclosure or bank-owned—that sold in May was $116,192, up less than one percent from the previous month but down two percent from a year ago. May was the first month with a year-over-year decrease in distressed median sale prices following 13 consecutive months with year-over-year increases. The median sales price of a distressed residential property was 43 percent below the median sales price of a non-distressed residential property in May, the biggest distressed discount since January 2006 when RealtyTrac first began tracking this metric.

The share of distressed sales dropped to a new low of 10.5 percent in May, down from 15.4 percent in April and down from 18.3 percent a year ago to the lowest level since January 2011—the earliest that RealtyTrac has data for this metric.

Metro areas with a population of at least 200,000 with the highest share of distressed sales were Flint, Michigan (26.0 percent), Tallahassee, Florida (24.2 percent), Memphis, Tennessee (24.1 percent), Pensacola, Florida (23.0 percent), and Ocala, Florida (21.7 percent).

“The market has shifted. In 2010, almost 30 percent of all listings in the Seattle area were distressed—either REO or subject to a short-sale—and today the figure about one-third of that. Although, still running at above historical averages, the decline in distressed sales is not surprising given that we continue to see a decline in these listings,” said Matthew Gardner, chief economist of Windermere Real Estate, covering the Seattle market. “Moreover, when we look at the decline in institutional investors—as well as all cash buyers—this is a sign that Seattle home prices have escalated to a point that it is increasingly difficult for these buyers to see significant returns on their investments.”

Bank-owned sales accounted for 3.9 percent of all residential property sales in May, down from 6.9 percent in the previous month and down from 6.9 percent the previous month and down from nine percent a year ago to the lowest level since January 2011.

Metros with the highest share of REO sales were Flint, Michigan (16.0 percent), Mobile, Alabama (13.1 percent), Tallahassee, Florida (12.6 percent), Palm Bay-Melbourne-Titusville, Florida (11.9 percent), and Fayetteville, North Carolina (11.9 percent).

Properties that sold while in the foreclosure process—but not yet bank-owned—accounted for 6.6 percent of all residential property sales in May, down from 8.5 percent the previous month and down from 9.2 percent a year ago to the lowest level since January 2011. Metros with the highest share of in-foreclosure sales were Chicago (14.8 percent), Rockford, Illinois (14.6 percent), Toledo, Ohio (13.4 percent), New Haven, Connecticut (12.7 percent), and Memphis, Tennessee (12.7 percent).

The top five metro areas with a population of at least 200,000 with the highest share of cash buyers were all in Florida: Naples-Marco Island (56.0 percent), Sarasota-Bradenton, (54.0 percent), Miami (53.4 percent), Ocala (49.9 percent), and Cape Coral-Fort Myers (49.7 percent). The top five metro areas with a population of at least 200,000 with the highest share of institutional investor purchases were Rockford, Illinois (13.4 percent), Tulsa, Oklahoma (12.6 percent), Roanoke, Virginia (12.6 percent), Memphis, Tennessee (10.2 percent), and San Antonio, Texas (8.4 percent).