Fixed-Rates Hit 2015 High

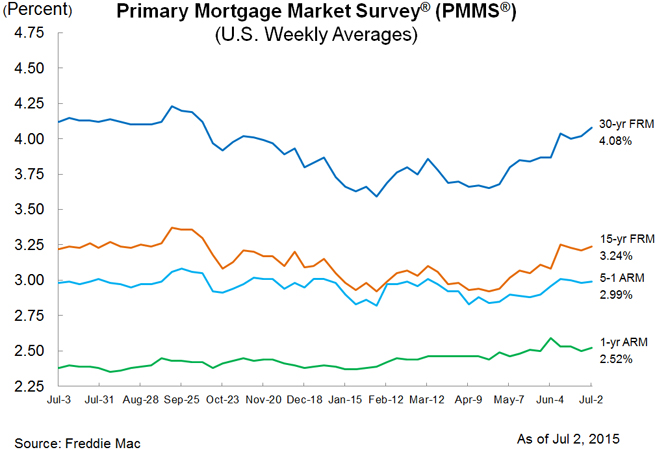

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates reaching new 2015 highs heading into the Fourth of July weekend and ahead of the June jobs report. This week, the 30-year fixed-rate mortgage (FRM) averaged 4.08 percent with an average 0.6 point for the week ending July 2, 2015, up from last week when it averaged 4.02 percent. A year ago at this time, the 30-year FRM averaged 4.12 percent. The 15-year FRM this week averaged 3.24 percent with an average 0.6 point, up from last week when it averaged 3.21 percent. A year ago at this time, the 15-year FRM averaged 3.22 percent.

"Overseas events are generating significant day-to-day volatility in interest rates," said Sean Becketti, chief economist, Freddie Mac. "Nonetheless, the week-to-week impact on most rates was modest—the 30-year mortgage rate increased just six bps, to 4.08 percent. The MBA composite index of mortgage applications fell 4.7 percent in response to what is now three consecutive weeks of mortgage rates over four percent. Other measures, however, confirmed continued strength in housing—pending home sales rose 0.9 percent, exceeding expectations, and the Case-Shiller house price index recorded another solid increase."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.99 percent this week with an average 0.4 point, up from last week when it averaged 2.98 percent. A year ago, the five-year ARM averaged 2.98 percent. The one-year Treasury-indexed ARM averaged 2.52 percent this week with an average 0.3 point, up from last week when it averaged 2.50 percent. At this time last year, the one-year ARM averaged 2.38 percent.