Is There a Right Day to Buy a House?

Do not be surprised if should see a major spike in home buying activity during Mondays in October, according to a new series of number crunching by RealtyTrac, which analyzed 32 million single family home and condo sales over the past 15 years in order to find the best times on the calendar for residential property purchases.

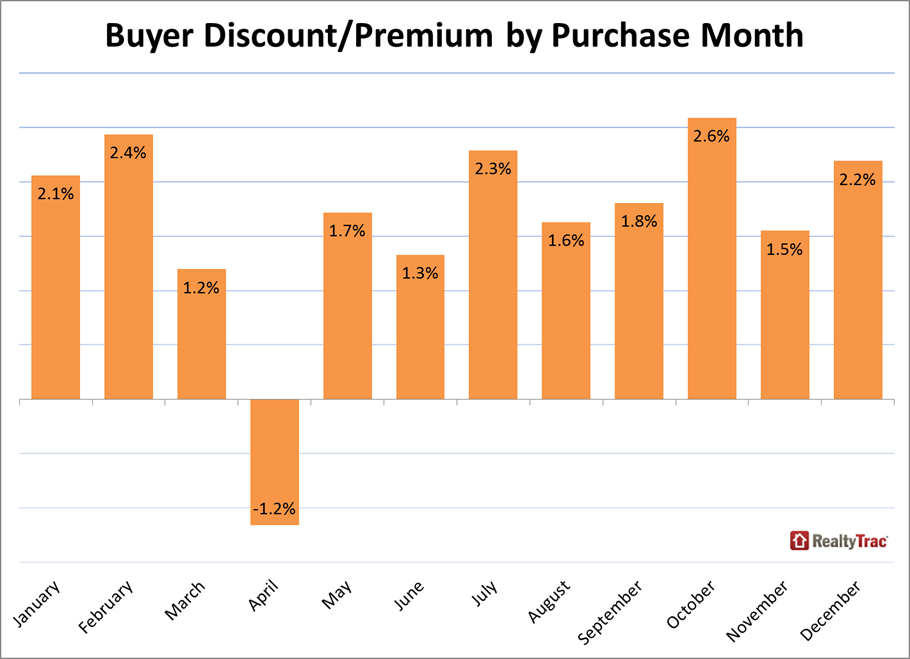

RealtyTrac found that out of 2.7 million single family home and condo sales that closed in October since 2000, buyers realized an average discount of 2.6 percent below full estimated market value at the time of sale. Following October as best months to buy were February, July, December and January, while the worst month of the year to close on the purchase of a home is April–RealtyTrac found buyers paid an average premium of 1.2 percent above estimated market value at the time of sale in that month.

And Monday is the best weekday to close on the purchase of a home, with buyers enjoying an average discount of 2.3 percent below full estimated market value at the time of sale on that day. Friday is second-best weekday, with buyers realizing an average discount of two percent, but Thursday is the worst day of the week to buy a home, with a one percent average discount.

RealtyTrac added that the best day of the year to close on the purchase of a home is October 8, noting that buyers that closed on that date have realized the biggest average discount—10.8 percent below estimated market value at time of sale—among any of the remaining 356 days in the year. The next best days of the year to close on a home purchase were Nov. 26 (10.1 percent discount), Dec. 31 (9.7 percent discount), Oct. 22 (9.6 percent discount) and Oct. 15 (9.1 percent discount).

The worst day of the year to close on a purchase, however, was Jan. 19, when buyers paid an average 9.6 percent premium above estimated market value at time of sale. Other dates to be avoided were Feb. 16 (9.5 percent premium), April 20 (9.5 percent premium), April 6 (8.4 percent premium) and April 27 (8.2 percent premium).