Negative Equity Retreats, Consumer Credit Defaults Up Slightly

This morning’s data news finds encouraging activity among at-risk homeowners and slightly troubling occurrences on the consumer credit default front.

CoreLogic has found 759,000 properties regaining equity in the second quarter, which brings the total number of mortgaged residential properties with equity at the end of the second quarter to approximately 45.9 million, or 91 percent of all mortgaged properties. Furthermore, borrower equity increased during the second quarter by $691 billion on a year-over-year basis.

CoreLogic added that the total number of mortgaged residential properties with negative equity is now at 4.4 million, or 8.7 percent of all mortgaged properties, a considerable decline from the level of 5.1 million homes, or 10.2 percent, in the first quarter; in the second quarter of 2014, 5.4 million homes, or 10.9 percent, had negative equity. The national aggregate value of negative equity was $309.5 billion at the end of the second quarter, down $28.5 billion from $338 billion in the first quarter; $350 billion in negative equity was reported in the second quarter of 2014.

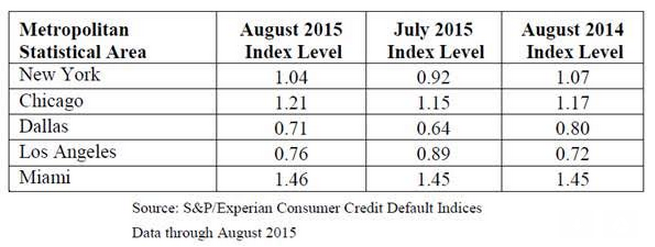

Nevada had the highest percentage of mortgaged residential properties in negative equity at 20.6 percent, followed by Florida (18.5 percent), Arizona (15.4 percent), Rhode Island (13.8 percent) and Illinois (13.1 percent). Combined, these five states accounted for 31.7 percent of negative equity. In contrast, Texas had the highest percentage of mortgaged residential properties in positive equity at 97.9 percent, followed by Alaska (97.6 percent), Hawaii (97.5 percent), Montana (97.2 percent) and Colorado (96.7 percent).

“Home price appreciation and foreclosure completions both reduce the number of homeowners with negative equity, the latter because most homeowners who lost homes through foreclosure had some level of negative equity," said Frank Nothaft, chief economist for CoreLogic. "Between June 2014 and June 2015, the CoreLogic national Home Price Index rose 5.6 percent and we reported the number of homes completing foreclosure proceedings exceeded one-half million. Both of these factors helped reduce the number of homeowners with negative equity by one million over the year ending in June.”

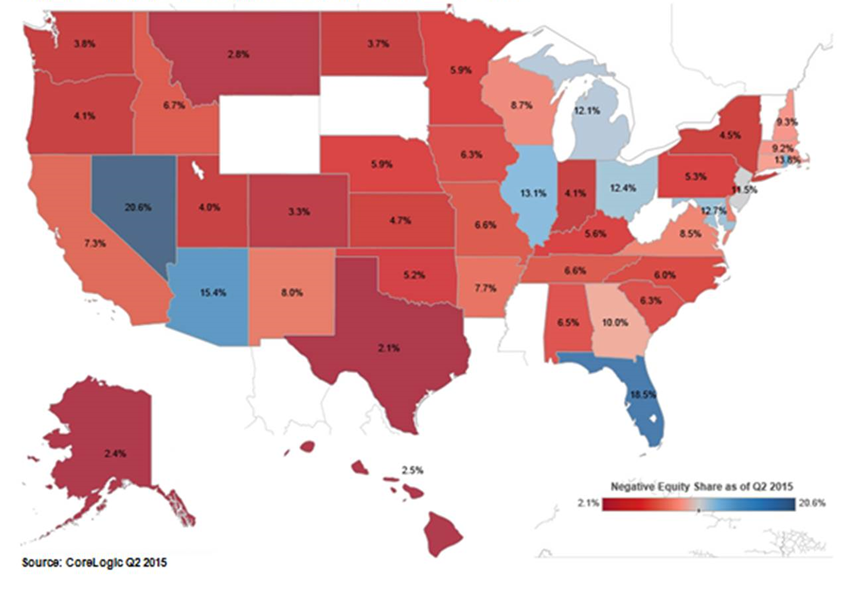

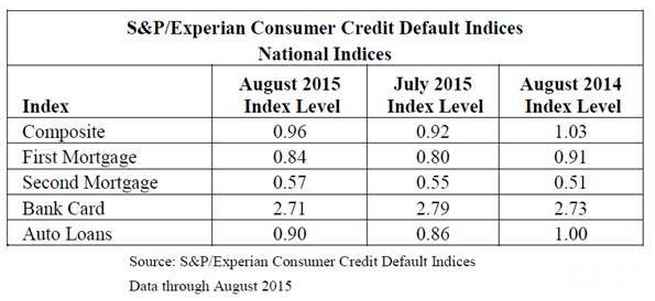

Separately, new data released by the S&P/Experian Consumer Credit Default Indices found small increases in the major default rates. The composite rate was 0.96 percent in August, up four basis points (bps) from July, with the first mortgage default rate increasing four bps to 0.84 percent and the second mortgage default rate increasing two bps to 0.57 percent. The auto loan default rate also saw an increase, while the bank card default rate saw a decline.

“The ongoing improvement in the consumer economy is reflected in consumer credit default rates,” said David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices. “Two economic areas showing strength are auto sales and housing. Car and light truck sales saw recent gains reaching an annual rate of about 17.5 million units as sales of new homes and housing starts picked up. To reflect that the growth in credit is largely due to loosening of credit standards indicating banks are willing to bear increased risk by approving more sub-prime consumers—which will lead the higher default rates.”