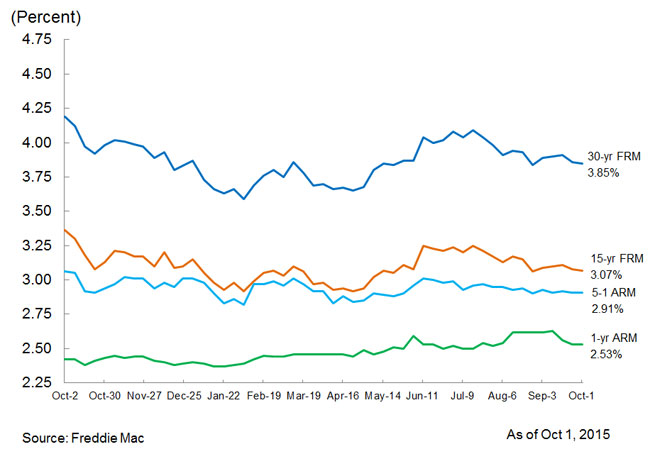

Fixed-Rates Remain Under the Four Percent Mark

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing the average fixed-rate mortgage (FRM) largely unchanged despite ongoing global growth concerns putting downward pressure on Treasury yields. The 30-year FRM averaged 3.85 percent with an average 0.6 point for the week ending Oct. 1, 2015, down from last week when it averaged 3.86 percent. A year ago at this time, the 30-year FRM averaged 4.19 percent. The 15-year FRM this week averaged 3.07 percent with an average 0.7 point, down from last week when it averaged 3.08 percent. A year ago at this time, the 15-year FRM averaged 3.36 percent.

"In contrast to the volatility in equity markets, the 10-year Treasury rate—a key driver of mortgage rates—varied just a little more than 10 basis points over the last week," said Sean Becketti, chief economist, Freddie Mac. "As a result, the 30-year mortgage rate remained virtually unchanged, dropping one basis point to 3.85 percent. This marks the tenth consecutive week of a sub-four-percent mortgage rate. Despite persistently low mortgage rates, the pending home sales index dropped 1.4 percent in August, suggesting possible tempering in existing home sales in September."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.91 percent this week with an average 0.4 point, unchanged from last week. A year ago, the five-year ARM averaged 3.06 percent. The one-year Treasury-indexed ARM averaged 2.53 percent this week with an average 0.2 point, unchanged from last week. At this time last year, the one-year ARM averaged 2.42 percent.