Foreclosures Up, Rates Inert, Fraud Risk Falls

There was one major nasty surprise, one big non-surprise and one nice mid-sized surprise awaiting mortgage professionals in today’s data reports.

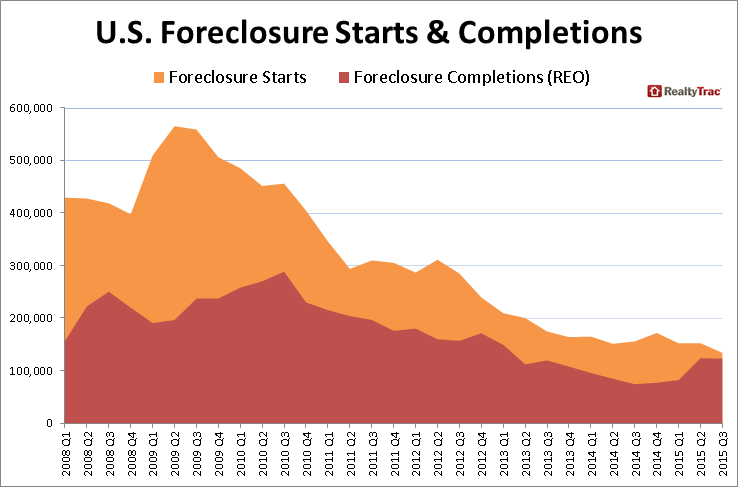

RealtyTrac is reporting a total of 327,258 U.S. properties with foreclosure filings — default notices, scheduled auctions and bank repossessions—in the third quarter, down five percent from the previous quarter but up three percent from the third quarter of 2014. This is the second consecutive quarter where U.S. foreclosure activity increased on a year-over-year basis following 19 consecutive quarters of year-over-year decreases.

A total of 133,811 properties started the foreclosure process in the third quarter, down 12 percent from the previous quarter and down 14 percent from a year ago to the lowest level since the third quarter of 2005. However, the 123,040 properties repossessed by the lender (REOs) in the third quarter was up 66 percent from a year ago, the largest year-over-year increase in bank repossessions since RealtyTrac began tracking quarterly foreclosure activity in the first quarter of 2008; this activity was down less than 1 percent from the previous quarter.

“The widespread rise in foreclosure activity in the third quarter compared to a year ago is the result of two starkly different trends taking place,” said Daren Blomquist, vice president at RealtyTrac. “In states such as New Jersey, Massachusetts, and New York, a flood of deferred distress from the last housing crisis is finally spilling over the legislative and legal dams that have held back some foreclosure activity for years. That deferred distress often represents properties with deferred maintenance that will sell at more deeply discounted prices, creating a drag on overall home values. On the other hand, in states such as Texas, Michigan and Washington, the third quarter increases are a sign that the foreclosure market has settled into a normalized pattern close to or even below pre-crisis levels, and in those states the overall housing market should easily absorb the additional foreclosure activity with little impact on home values.”

New Jersey’s year-over-year foreclosure activity increased 27 percent, making it the state with the highest foreclosure rate, with one in every 171 housing units with a foreclosure filing during the quarter. Although New Jersey’s foreclosure starts were down 28 percent from a year ago, scheduled foreclosure auctions increased 61 percent and bank repossessions jumped 351 percent. Atlantic City, New Jersey’s long-ailing resort destination, had the highest foreclosure rate among the major metropolitan areas, with one out of every 97 housing in this unhappy situation. Florida had the nation’s second highest foreclosure rate with one in every 186 housing units with a foreclosure filing, and five Florida cities posted third quarter foreclosure rates among the 10 highest for metro areas.

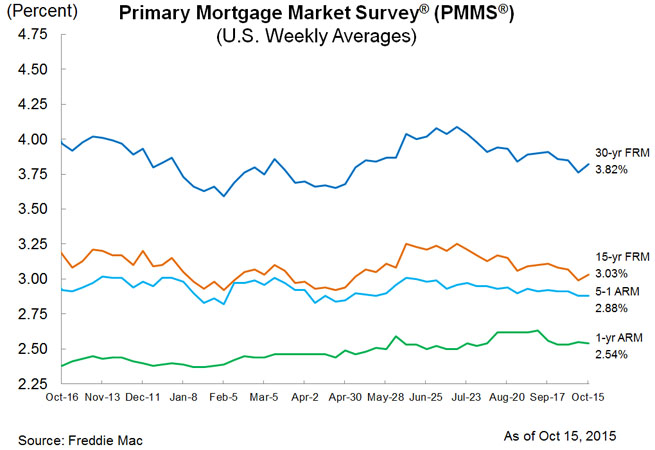

Separately, this week marks the twelfth consecutive with mortgage rates stuck below the four percent level. The latest Primary Mortgage Market Survey (PMMS) from Freddie Mac found the 30-year fixed-rate mortgage (FRM) averaged 3.82 percent with an average 0.6 point for the week ending October 15, up from last week when it averaged 3.76 percent, but below the 3.97 percent level where it averaged a year ago. The 15-year FRM this week averaged 3.03 percent with an average 0.6 point, up from last week when it averaged 2.99 percent; it averaged 3.18 percent at this time in 2014.

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.88 percent this week with an average 0.4 point, unchanged from last week. A year ago, the five-year ARM averaged 2.92 percent. And the one-year Treasury-indexed ARM averaged 2.54 percent this week with an average 0.2 point, down from 2.55 percent last week. At this time last year, it averaged 2.38 percent.

Sean Becketti, chief economist at Freddie Mac, forecast that life below four percent may be the new normal for the foreseeable future.

“Late-breaking news suggests mortgage rates may remain in this territory a while longer,” Becketti said. “After this week's survey closed, Federal Reserve Governor Daniel Tarullo was quoted suggesting the Fed may not act this year, and Wednesday the 10-year Treasury closed under two percent in reaction to economic releases indicating weak consumer demand.”

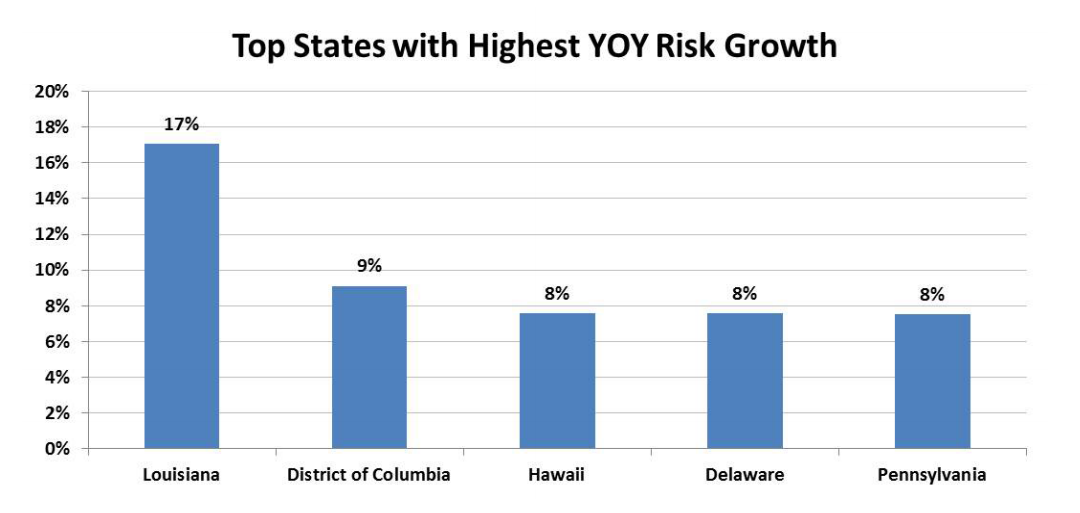

While the rate news may not have been encouraging, there was a healthy degree of good news in CoreLogic’s latest Mortgage Fraud Report, which found an 8.9 percent year-over-year decrease in fraud risk at the end of the second quarter and a year-over-year drop in the total value of applications with fraud or serious misrepresentations: from $17.3 billion at the end of the second quarter compared with $19.8 billion a year earlier.

CoreLogic also found approximately 12,814 mortgage applications, or 0.67 percent of all mortgage applications, contained indications of fraud during the second quarter, as compared with the reported 11,100 or 0.69 percent in the second quarter of 2014. Florida maintained its position as the nation’s highest risk state, with Sunshine State metro areas occupying half of the top markets with the greatest risk for mortgage fraud.

“New regulations, like Qualified Mortgage and Ability to Repay, as well as stricter credit overlays, have resulted in greater scrutiny of mortgage applications,” said Susan Allen, senior vice president of Mortgage Analytics at CoreLogic. “Greater scrutiny, in turn, has had a positive impact on the rate of fraudulent applications. In the markets where fraud remains strong, there are also significant inventories of distressed properties. Typically, this leads to large value discrepancies with nearby properties, which increases the risk of incorrect valuation, fraud-for-profit schemes, and occupancy fraud on properties recently converted to rentals.”