Denials Under HMDA

Question: We realize there are reasons for denials under HMDA. However, how many reasons for denial are we allowed? Also, what are the categories for denials?

Answer

For HMDA purposes, a financial institution may elect to report the reason it denied a loan. It may report up to three reasons for denial. [12 CFR § 203.4(c)]

To understand the categories for denials, it is best to base the denial reasons specified in the model Adverse Action Notice (i.e., Regulation B notice) for the denial reasons under HMDA. The model form for Adverse Action is Form C-1 in Appendix C to Regulation B, the implementing regulation of the Equal Credit Opportunity Act.

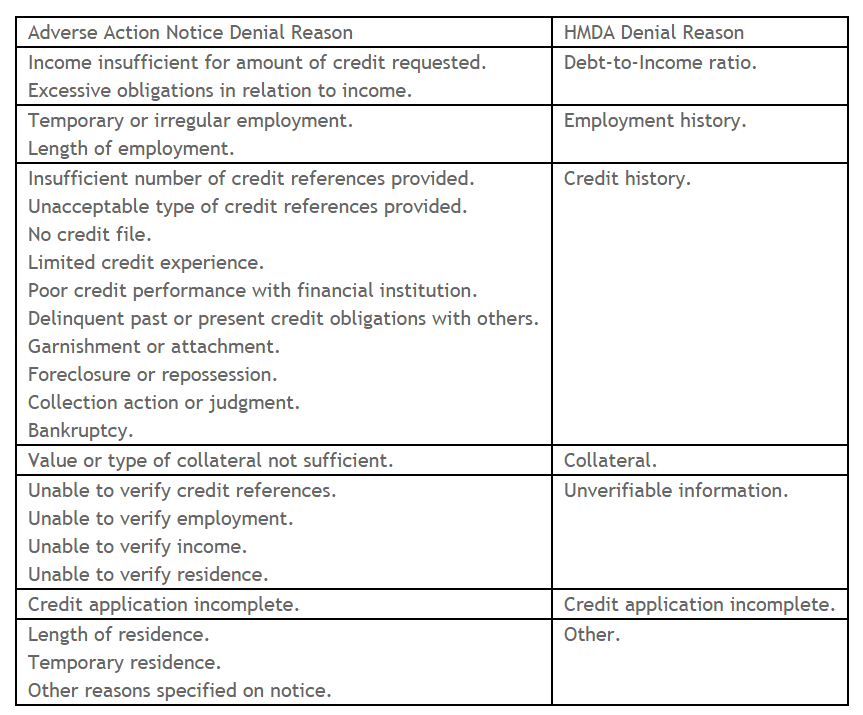

It is possible to extrapolate the denial categories into more precise reasons. The following table provides the adverse action notice denial reason and its corresponding HMDA denial reason. [12 CFR Part 203, Appendix A]

Jonathan Foxx is president and managing director of Lenders Compliance Group, Brokers Compliance Group, Servicers Compliance Group and Vendors Compliance Group, national companies devoted to providing regulatory compliance advice and counsel to the mortgage industry. He may be contacted by phone at (516) 442-3456, by e-mail at [email protected] or visit www.LendersComplianceGroup.com.