Diversify Your Product Line With Non-Agency Mortgages

The Federal Reserve announced last month that it won’t be increasing the funds rate. Still, we are likely to see rate liftoff from the Fed in the near future. It’s not a matter of “if,” but rather “when” they’ll raise rates. Many analysts predict that when this happens, it will signal the beginning of the end of a decades-long secular bond market run; but the move is sure to have a profound effect in mortgage markets, as well.

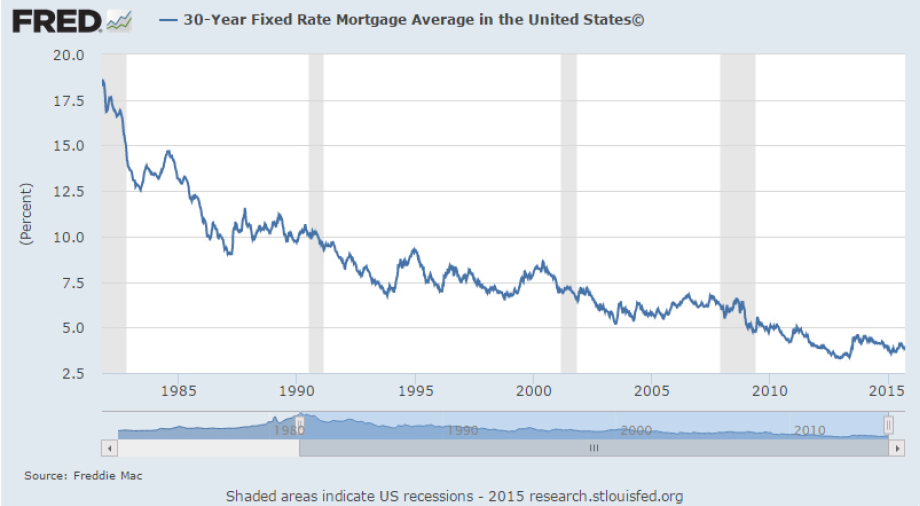

Most notably, the mortgage refinance market stands to take a hit from rising rates. Volume will start to dry up as mortgage rates reverse their 34-year downtrend from the high teens of the early 1980s.

Lenders that rely heavily on refinancing need to come up with a way to bolster their new mortgage pipeline in order to replace lost volume. The best way to do this is by diversifying into non-agency mortgage products.

Since the housing crisis, the hands of lenders have been tied as they’ve had limited options to issue loans not eligible for sale to government-sponsored enterprises (GSEs). Within the last two years, however, there has been a reemergence in the non-agency market, as lenders are once again offering these products to their networks. Now, there exists a diverse mortgage product mix on the market that can meet the needs of almost any borrower.

Here are some examples of the types of borrowers that can benefit from non-agency products:

►Borrowers who have experienced a recent credit event, such as a foreclosure or short sale.

►Borrowers that don’t have W-2 income and instead rely off of income from investment properties.

►Self-employed borrowers whose tax returns may not necessarily reflect their true income due to business write-offs.

►Foreign nationals that don’t have credit in the U.S. system.

►Borrowers that have significant savings, but limited income.

Loan originators need to start taking advantage of these new products if they want to be able to satisfy the growing demand of their referral bases. With a wider array of ways to address customer needs, they stand to increase their reach to a subset of buyers that has been otherwise underserved for the last eight years. If all they offer is Fannie Mae, Freddie Mac, FHA, and VA loans, they’re stuck competing with the majority of other lender that do the same thing. They also run the risk of their referral partners looking for a provider with a more diverse product offering.

Tom Hutchens is senior vice president of sales and marketing at Angel Oak Mortgage Solutions, an Atlanta-based wholesale lender currently licensed in 24 states. Tom has been in the real estate lending business for nearly 20 years. He may be reached by phone at (855) 539-4910 or e-mail [email protected].

This article originally appeared in the October 2015 print edition of National Mortgage Professional Magazine.