Rates Mostly Unchanged, Cash Sales Drop

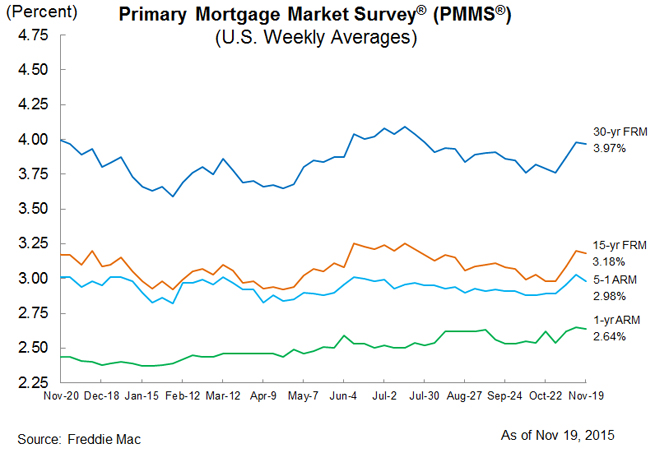

The average fixed mortgage rates were mostly stagnant in the latest Primary Mortgage Market Survey (PMMS) by Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 3.97 percent with an average 0.6 point for the week ending Nov. 19, barely down from last week when it averaged 3.98 percent, and the 15-year FRM this week averaged 3.18 percent with an average 0.5 point, down slightly from last week when it averaged 3.20 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.98 percent this week with an average 0.5 point, down from last week when it averaged 3.03 percent, and the one-year Treasury-indexed ARM averaged 2.64 percent this week with an average 0.3 point, down from 2.65 percent last week.

While rates mostly went nowhere, cash sales were in decline. According to new CoreLogic data, cash sales accounted for 31.7 percent of all home purchase transactions in August, a 34.9 percent drop on a year-over-year basis. On a month-over-month basis, the cash sales share barely inched up by 0.8 percentage points from July.

Real estate-owned properties had the largest cash sales share per sale sector in August with 57.9 percent of all transactions, although these sales only made up six percent of the total volume of August purchasing.

Alabama had the largest statewide share of cash sales in August at 47.5 percent, followed by Florida (45.2 percent), New York (42.4 percent), West Virginia (39.6 percent) and Missouri (39.5 percent). On a metro level, Florida’s Miami-Miami Beach-Kendall corridor had the highest cash sales share at 51.7 percent, followed by Philadelphia at 51 percent.