Data Finds Strength in Residential and Commercial Real Estate

As the nation gets ready for the Thanksgiving break, both the residential and commercial real estate industries received a healthy dose of pre-holiday good news.

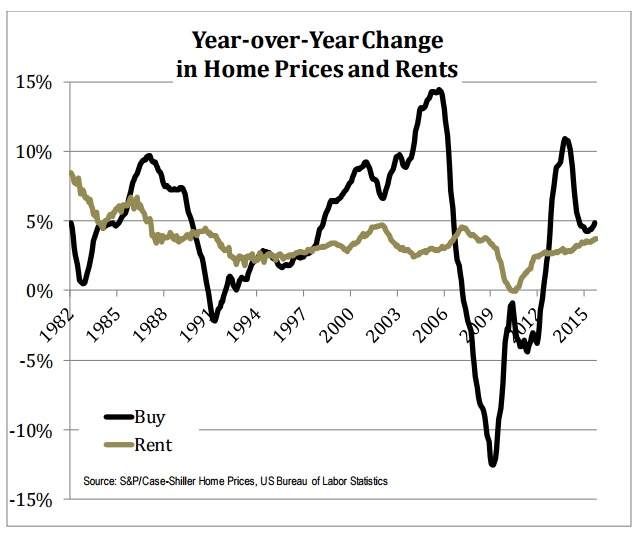

The latest S&P/Case-Shiller Home Price Indices found gains in housing prices. The S&P/Case-Shiller U.S. National Home Price Index saw a 4.9 percent annual increase in September versus a 4.6 percent increase in August. The 10-City Composite increased five percent year-over-year while the 20-City Composite’s year-over-year gain was 5.5 percent for the same period.

The greatest year-over-year increases were found in San Francisco (up 11.2 percent), Denver (up 10.9 percent) and Portland (up 10.1 percent). Seventeen cities reported greater price increases in the year ending September, while Phoenix’s September gain of 5.3 percent was that market’s tenth consecutive increase in annual price gains.

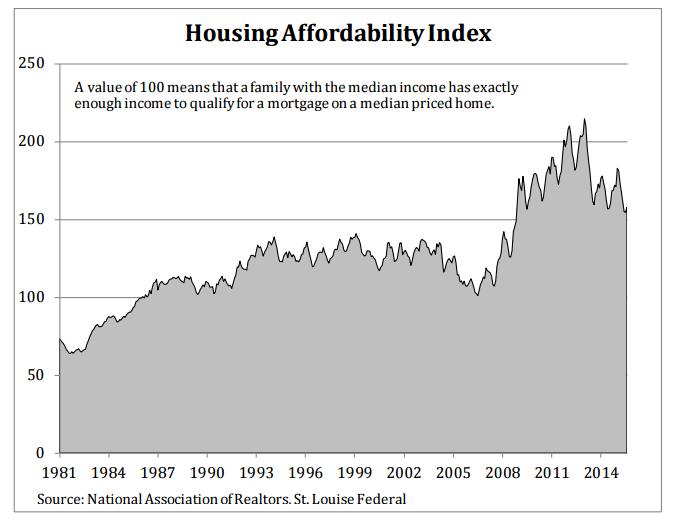

David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, predicted that housing will remain strong even if the Federal Reserve hikes rates next month.

“With unemployment at five percent and hints of higher inflation in the CPI, most analysts expect the Federal Reserve to raise its Fed Funds target range to 25 to 50 basis points, the first increase since 2006,” Blitzer said. “While this will make news, it is not likely to push mortgage rates far above the recent level of four percent on 30 year conventional loans. In the last year, mortgage rates have moved in a narrow range as home prices have risen; it will take much more from the Fed to slow home price gains.”

“The housing market’s fundamentals remain strong, and we expect moderate home price appreciation to continue—supported by moderate income growth and historically low interest rate," said Genworth Mortgage Insurance Chief Economist Tian Liu. "We’re glad to see the continued upward trajectory in home price carry into the latter half of the year.”

On the commercial real estate side, the National Association of Realtors’ (NAR) quarterly forecast is pointing to a decrease in office vacancy rates (a predicted 0.8 percent drop to 14.8 percent) and in industrial space (a predicted 1.4 percent drop to 9.7 percent). However, NAR forecasts a rise in multifamily vacancies over the next year, from 6.1 percent to 7.3 percent.

“The best days for multifamily housing could be winding down as new construction has already surpassed historical averages,” said NAR Chief Economist Lawrence Yun. “This sector has been the industry’s top performer over the past several years as a result of younger households struggling to become homeowners and the demand for apartments far exceeding supply in many markets.”