LendingTree Joins Google Compare for Mortgages

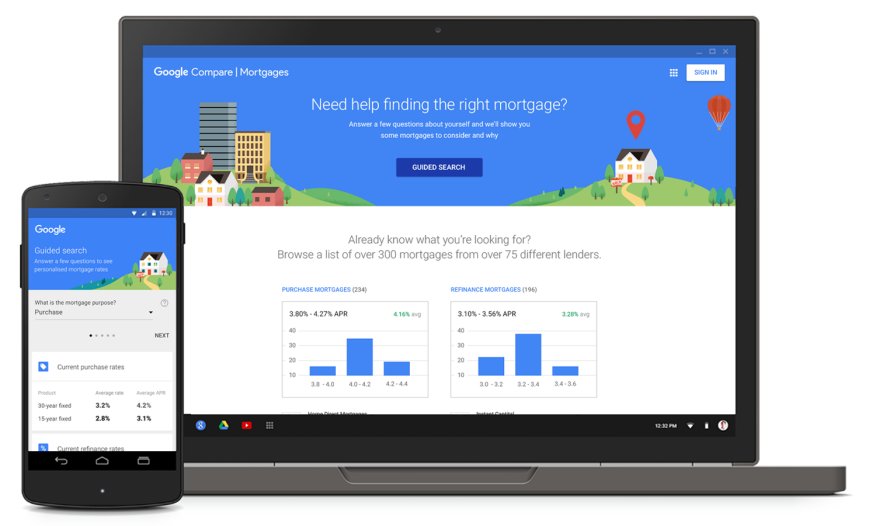

LendingTree has launched an integration with Google Compare for Mortgages, the latest addition to a suite of Google Compare products designed to help consumers make confident, more informed financial decisions.

LendingTree has launched an integration with Google Compare for Mortgages, the latest addition to a suite of Google Compare products designed to help consumers make confident, more informed financial decisions.

Google Compare now enables Google users to search for and compare mortgages online through an intuitive rate table experience, where LendingTree and its network of lenders, as well as other lending partners, provide customized rate quotes based on the information provided. When searching for a mortgage-related term on Google, consumers are invited to the Google Compare Mortgages page within the search results. After users provide a few additional pieces of information, such as loan amount and home value, Google will display relevant mortgage rates from LendingTree and other lending partners. And much like LendingTree, the experience allows for a comparison of rate quotes from a variety of mortgage providers along with ratings and reviews from LendingTree customers.

"We're thrilled to be a part of Google Compare, further helping to connect prospective borrowers with qualified mortgage providers as the transition to online lending accelerates," said Doug Lebda, founder and CEO of LendingTree. "The choice and convenience offered to consumers is imperative when loan shopping online, and Google Compare makes the process even easier. Our expertise in providing an online rate table experience combined with our strong lender network gives LendingTree a distinct advantage when reaching potential borrowers through the online channel. We congratulate Google on the launch and are excited to be working with Google at this early stage."