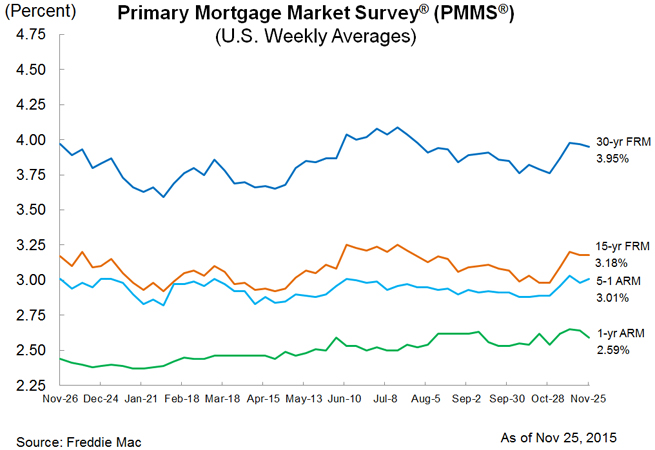

Black Friday Sale: Fixed Rates Remain Under Four Percent

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing the average 30-year fixed rate mortgage (FRM) declining slightly leading up to the Thanksgiving holiday. The average 30-year FRM hasn't risen above four percent since the week of July 23rd of this year, which is helping homebuyer affordability in the face of rising house prices due to low levels of inventory in many markets. This week, the 30-year FRM averaged 3.95 percent with an average 0.7 point for the week ending Nov, 25, 2015, down from last week when it averaged 3.97 percent. A year ago at this time, the 30-year FRM averaged 3.97 percent. The 15-year FRM this week averaged 3.18 percent with an average 0.6 point, unchanged from last week. A year ago at this time, the 15-year FRM averaged 3.17 percent.

"In a quiet week leading up to the Thanksgiving holiday, the 30-year mortgage rate dipped 2 basis points to 3.95 percent," said Sean Becketti, chief economist, Freddie Mac. "Economic releases over the last week contained no major surprises, and none are expected in the next few days. The year is winding down, and the only remaining market dates of note are Dec. 4—the last employment report of the year—and Dec. 15-16, the long-awaited FOMC meeting."

Also this week, the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.01 percent this week with an average 0.5 point, up from last week when it averaged 2.98 percent. A year ago, the five-year ARM averaged 3.01 percent. The one-year Treasury-indexed ARM averaged 2.59 percent this week with an average 0.3 point, down from 2.64 percent last week. At this time last year, the one-year ARM averaged 2.44 percent.