New Data Provides Mixed Picture of Mortgage Industry

Two new studies from the Mortgage Bankers Association (MBA) find the industry in a cautiously optimism, while new data from CoreLogic reaffirms an improving environment for at-risk homeowners.

The MBA Quarterly Mortgage Bankers Performance found that independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,238 on each loan they originated in the third quarter, which is down from the $1,522 per loan level recorded in the second quarter but up from the $897 per loan level reported a year ago.

Average production volume reached $614 million per company in the third quarter, which was down from a study-high $657 million per company in the second quarter. Volume by count per company averaged 2,609 loans in the third quarter, down from another study-high 2,714 loans in the second quarter—yet the third quarter average production volume in both dollar and count marked the second-highest reported since the MBA started publishing its performance reports seven years ago.

Also, the average pre-tax production profit was 55 basis points in the third quarter, down from 67 basis points in the second quarter but above the average of 54 basis points that has been recorded since the performance report began.

There were three areas where the third quarter outperformed the second quarter. The first came in the purchase share of total originations by dollar volume, which rose to 70 percent in the third quarter from 62 percent in the second quarter. The second came in the jumbo share of total first mortgage originations by dollar volume: that was up to 9.09 percent in the third quarter from 9.07 percent in the second quarter.

The third area of increased activity, however, involved total loan production expenses: that increased to $7,080 per loan in the third quarter, from $6,984 in the second quarter. Within that category was an increase in the "net cost to originate," which was$5,549 per loan in the third quarter, up from $5,372 in the second quarter.

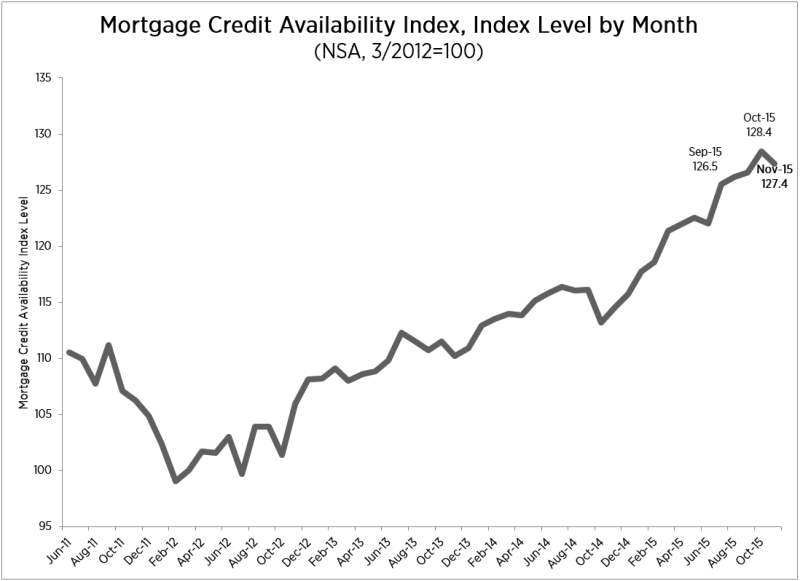

Separately, the MBA released its latest Mortgage Credit Availability Index (MCAI) report, which found mortgage credit availability decreased in November; this marks the second decrease in the past year.

Three of the four component indices saw declines—the Conventional MCAI (down two percent), the Conforming MCAI (down one percent), and the Jumbo MCAI (down 0.8 percent). Only the Government MCAI increased, albeit at a scant 0.1 percent.

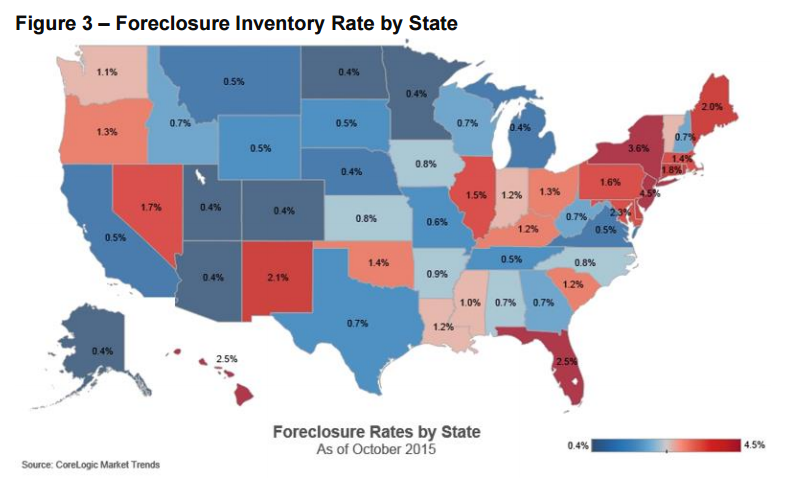

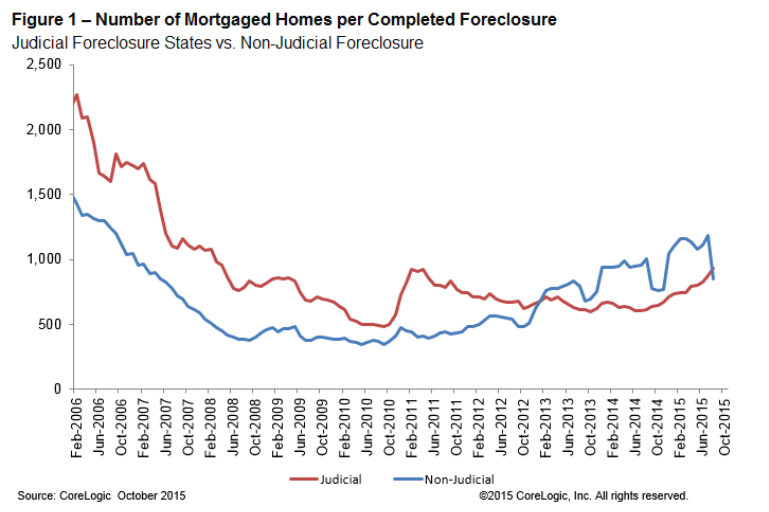

There was better news in CoreLogic’s latest National Foreclosure Report, which found the foreclosure inventory declined by 21.5 percent and completed foreclosures declined by 27.1 percent in October on a year-over-year basis, while the number of completed foreclosures nationwide decreased from 51,000 in October 2014 to 37,000 in October 2015. On a month-over-month basis, completed foreclosures decreased by 12.3 percent from the 43,000 reported in September.

As of October, the national foreclosure inventory included approximately 463,000, or 1.2 percent of all homes with a mortgage, down from 589,000 homes or 1.5 percent, in October 2014. This is lowest rate recorded by CoreLogic since November 2007. And the number of mortgages in serious fell by 19.7 percent from October 2014 to October 2015 with 1.3 million mortgages, or 3.4 percent, in this category—the lowest serious delinquency rate since December 2007.

The five states with the highest number of completed foreclosures for the 12 months ending in October—Florida (86,000), Michigan (59,000), Texas (30,000), Georgia (25,000) and California (24,000) —accounted for almost half of all completed foreclosures nationally.

"We are heading into 2016 with the lowest foreclosure inventory in eight years thanks to escalating home values and progressive improvement in the U.S. economy,” said Anand Nallathambi, president and CEO of CoreLogic.