Fewer Mortgage Apps, More Loan Mods

The level of mortgage applications remained desultory as the state of loan modifications continued to score impressive results, according to the latest housing data.

The Mortgage Bankers Association’s latest Weekly Mortgage Applications Survey found the Market Composite Index down 1.1 percent on a seasonally adjusted basis from one week earlier; the unadjusted index recorded a two percent drop. The seasonally adjusted Purchase Index fell by three percent from one week earlier and the unadjusted index took a seven percent tumble, although it was 34 percent higher than the same week one year ago.

There was positive movement on the refi side, as the Refinance Index increased by one percent from the previous week as the refinance share of mortgage activity increased to 60.7 percent of total applications, up from 58.7 percent the previous week. The government loan programs were mostly stagnant: the FHA share of total applications remained unchanged from 14 percent the week prior, while the VA share of total applications bumped up to 11.2 percent from the previous week’s 10.8 percent and the USDA share of total applications slipped to 0.6 percent from 0.7 percent the week prior.

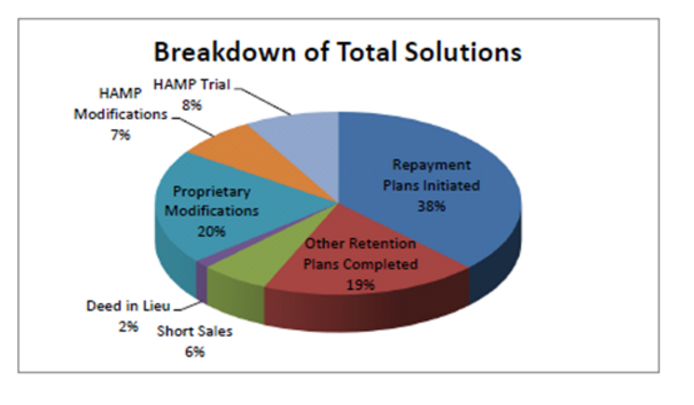

More significant movement was found on the servicing side, as the latest data from HOPE NOW reported roughly 109,000 total loan modifications, short sales, deeds in lieu and workout plans in October, compared to an estimated 26,000 foreclosure sales. The October data included approximately 30,000 loan modifications, 6,600 short sales and 1,500 deed in-lieu completions, as well as 57,000 foreclosure starts. The number of serious delinquencies totaled approximately 1.67 million in October, virtually unchanged from September.

“As we move into 2016, we are identifying markets that still need assistance and planning accordingly with our industry members and other partners,” said Erik Selk, HOPE NOW’s executive director. “We expect a robust combination of loss mitigation events, first time home buyer fairs and community housing roundtables to take place in several selected markets for next year.”