Americans Are Flipping Houses Again!

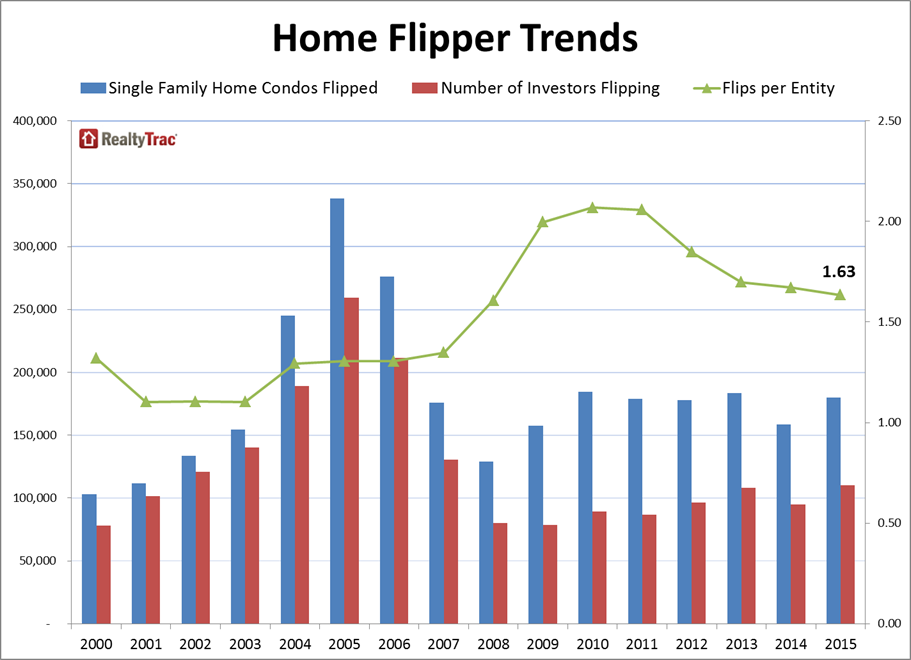

One of the trends that dominated the housing world in the years leading up to the housing bubble is back. According to RealtyTrac’s Year-End and Q4 2015 U.S. Home Flipping Report, 179,778 single family homes and condos were flipped last year, which totals 5.5 percent of all residential sales during the year.

Last year’s number was slightly higher than the 5.3 percent share in 2014, and is also the first annual increase in the share of homes flipped after four consecutive years of decreases. Furthermore, the number homes flipped in 2015 saw year-over-year increases in 83 of 110—or 75 percent—of major metro areas analyzed for the report (75 percent).

The states with the highest share of flips in 2015 were Nevada (8.8 percent); Florida (eight percent); Alabama (7.4 percent); Arizona (7.1 percent); and Tennessee (6.9 percent). The metro areas with the biggest year-over-year increase in share of flips were Lakeland, Fla. (up 50 percent); New Haven, Conn. (up 45 percent); Jacksonville, Fla. (up 41 percent); Homosassa Springs, Fla. (up 40 percent); and Akron, Ohio (up 37 percent). Among metro markets, the Miami area had the most homes flipped, with 10,658, representing 8.6 percent of all Miami-area home sales for 2015—a four percent increase from 2014.

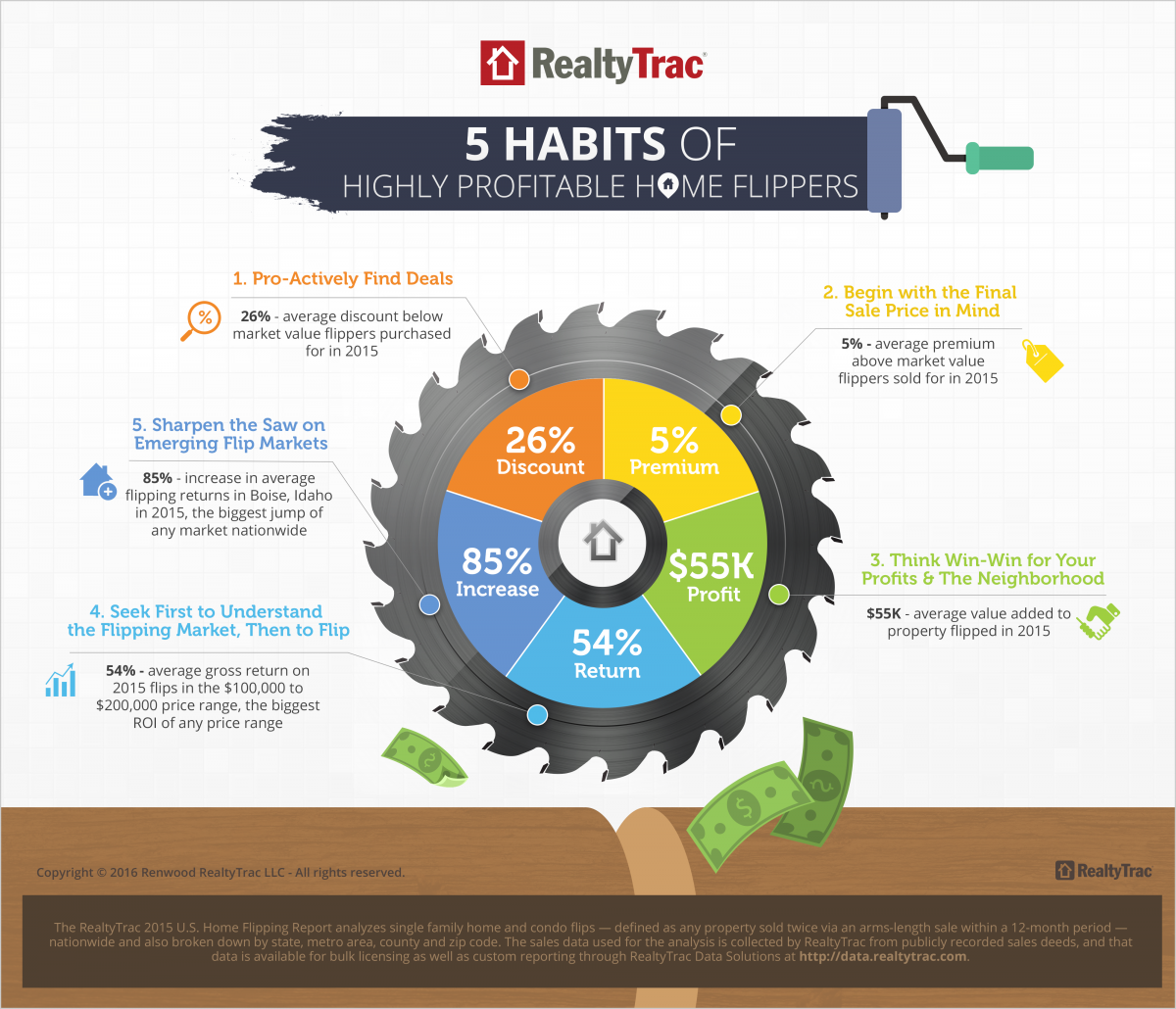

And what is the payoff for these flips? RealtyTrac reports that homes flipped in 2015 yielded an average gross profit of $55,000 nationwide, the highest level in 10 years. The average gross flipping profit represented an average gross return on investment of 45.8 percent, up from 44.2 percent in 2014 and up from a 35.3 percent in 2005.

“As confidence in the housing recovery spreads, more real estate investors and would-be real estate investors are hopping on the home flipping bandwagon,” said Daren Blomquist, senior vice president at RealtyTrac. “Not only is the share of home flips on the rise again, but we also see the flipping trend trickling down to smaller investors who are completing fewer flips per year. The total number of investors who completed at least one flip in 2015 was at the highest level since 2007, and the number of flips per investor was at the lowest level since 2008.”