Mortgage Rates and Availability Take a Dive

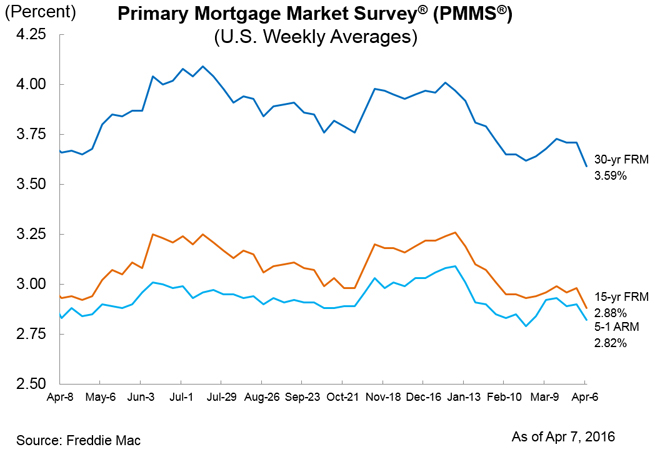

Today could certainly qualify as a Throwback Thursday for mortgage rates—they reached a low that has not been seen since February 2015.

According to Freddie Mac’s Primary Mortgage Market Survey (PMMS) for the week ending April 7, the 30-year fixed-rate mortgage (FRM) averaged 3.59 percent, down from last week’s 3.71 percent. The 15-year FRM this week averaged 2.88 percent, down from last week’s 2.98 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.82 percent this week, down from last week’s 2.90 percent.

“Mortgage rates this week registered the delayed impact of last week's sharp drop in Treasury yields as the 30-year mortgage rate fell 12 basis points to 3.59 percent,” said Sean Becketti, chief economist at Freddie Mac. “This rate marks a new low for 2016 and matches last year's low in February 2015. Low mortgage rates and a positive employment outlook should support a strong housing market in the second quarter of 2016.”

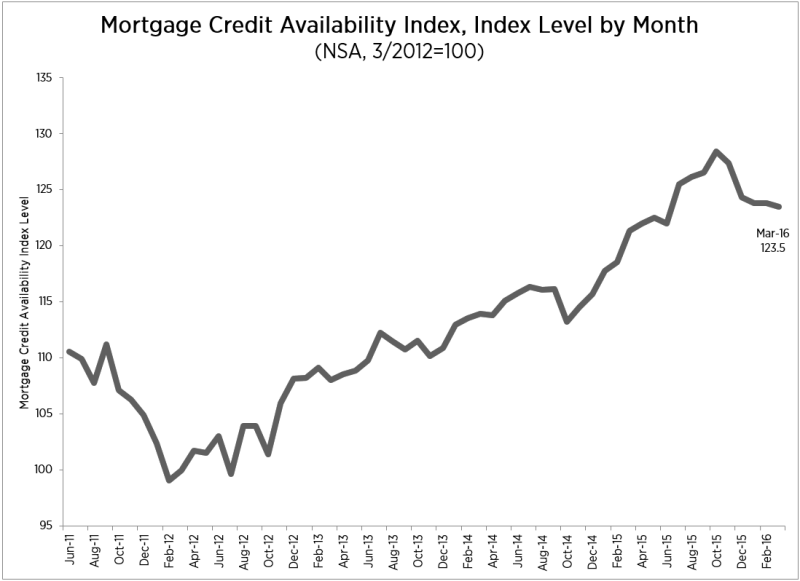

Separately, the latest Mortgage Credit Availability Index (MCAI) report from the Mortgage Bankers Association found the main index taking a slight 0.2 percent dip in March, resting at the 123.5 mark. Of the four component indices, only the Government MCAI saw an uptick with a 0.9 percent jump, while declines were felt on the Conventional MCAI (down 1.6 percent), the Jumbo MCAI (down 0.2 percent) and the Conforming MCAI (down 0.4 percent).

"Administrative changes drove declines in the availability of conventional and super conforming loan programs, and those were partially offset by slightly relaxed lending standards on government lending programs which includes FHA, VA, and RHS," said Lynn Fisher, MBA's vice president of research and economics.