HOPE NOW: 97,000 Non-Foreclosure Solutions in February

Mortgage industry provided 97,000 non-foreclosure solutions for struggling homeowners in February, according to new data from the non-profit HOPE NOW alliance.

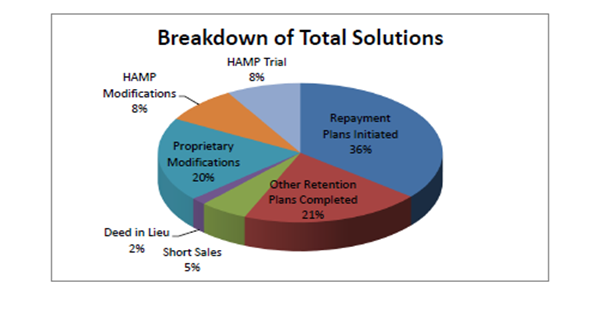

Approximately 27,000 loan modifications were completed in February, unchanged from January, while approximately 5,300 short sales were completed, an eight drop decline from one month earlier. Roughly 1,600 deed in-lieus were completed in February, down four percent from January.

However, the 62,000 foreclosure starts during February was seven percent higher than January’s 58,000 number. But the approximately 28,000 foreclosure sales level was 15 percent below January’s 33,000 level. Also in decline were the number of serious delinquencies: approximately 1.64 million in February, compared to 1.84 million in January, a decrease of 11 percent.

Eric Selk, HOPE NOW’s executive director, warned that there was still a great deal of work that needed to be done on behalf of struggling homeowners.

“Although the housing market has made a recovery on a national level, there are still pockets of the country experiencing a slower recovery and that has been the focus of HOPE NOW’s outreach efforts in 2016,” he said. “We will be focusing most of our efforts on the East and Southeast United States. We have planned three events in Florida, a state still recovering from the housing crisis.”