Data Reports Analyze Mortgage Credit Availability and Affordability

Getting a mortgage can be a challenge to some people, but keeping up with mortgage payments can be especially difficult for people on lower incomes. Two new data reports issued today detail some troubling aspects that cloud today’s mortgage industry.

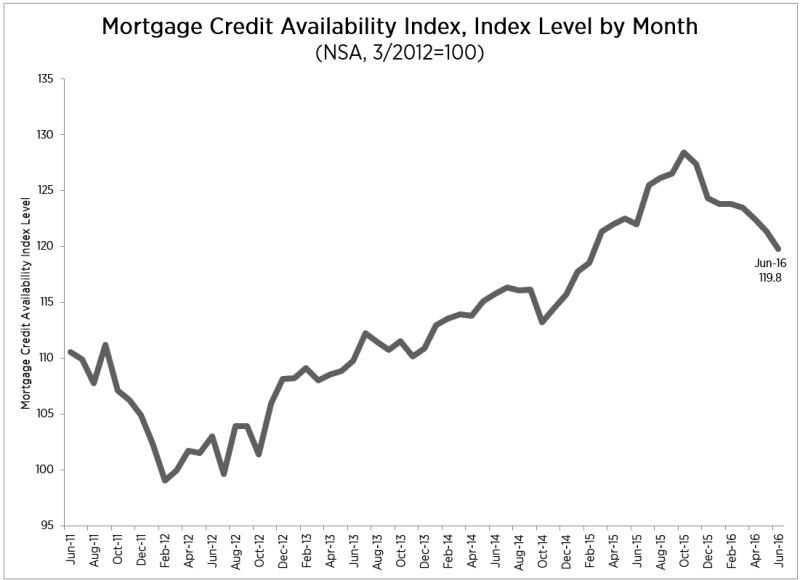

The Mortgage Bankers Association’s (MBA) Mortgage Credit Availability Index (MCAI) dropped 1.3 percent last month to 119.8 in June. All four component indices took a dive in June: the Conventional MCAI (down 2.4 percent), the Conforming MCAI (down 1.8 percent), the Jumbo MCAI (down 0.9 percent) and the Government MCAI (down 0.3 percent).

“Credit availability decreased over the month driven primarily by a decrease in availability of conventional conforming loan offerings,” said Lynn Fisher, MBA’s vice president of research and economics. “In particular, a number of investors discontinued their conventional high balance seven-year adjustable rate loan programs (agency jumbo ARM) while leaving their five-year and 10-year ARM programs unchanged.”

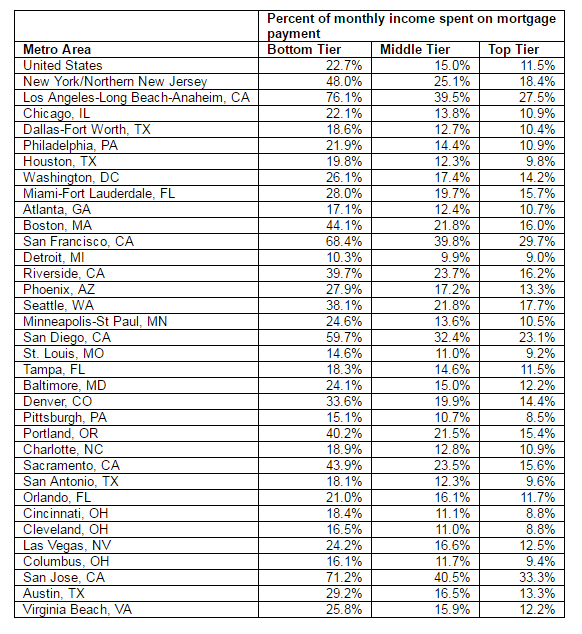

Separately, Zillow released a new study that determined people with low incomes spend nearly 23 percent of their income on monthly mortgage payments, while high-income earners spend 11.5 percent of their income on monthly house payments. In one-third of the major housing markets, the cost of housing for low-income earners exceeds 30 percent of the median, while in four California markets—Los Angeles, San Jose, San Francisco and San Diego—the level is higher than 50 percent.

Although the current level of mortgage payments for low-income earners is below its 2007 peak—when this demographic spent nearly 40 percent of their income on housing—the situation is exacerbated today due to a shrinkage in affordable homeownership options.

"Housing affordability is a different story for low-income Americans than for median and high-earning people," said Zillow Chief Economist Svenja Gudell. "They are spending much more of their income on housing, even when they buy the least expensive homes. On top of that, we know that the least expensive homes are gaining value the fastest and are the most scarce, making it hard to find a home to buy even if you can afford one. From a high level view, mortgage affordability looks pretty good across most of the country, but it's not good for everyone."