Zillow: Home Values Rise for 48th Straight Month

U.S. home values are now entering their fourth year of consistent appreciation, according to new data released by Zillow.

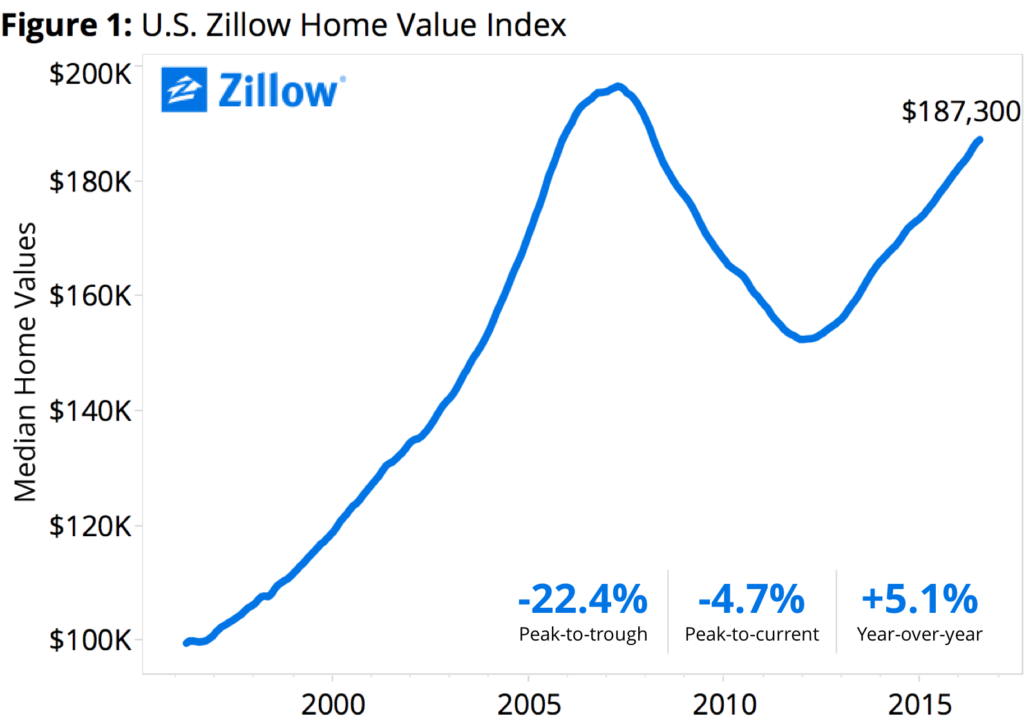

July marked the 48th straight month with rising home values, with Zillow’s Home Value Index reaching $187,300 last month. While July’s level represented a five percent year-over-year increase, it was still 4.7 percent below the April 2007 peak of $196,600. Among the major metro markets, Portland experienced the greatest appreciation in July, with home values reaching a median value of $334,900, up 14.7 percent from last year.

On the rental side of the housing world, rents were up on national basis by two percent over the past year, with the Zillow Rent Index registering at $1,408 for July. This is the 47th straight month rents have appreciated. San Jose and San Francisco had the nation’s highest median monthly rents at $3,520 and $3,047, respectively.

"The consistent rise in home values that we've been seeing for the past four years masks a number of region-specific trends that have taken place over the past few months," said Zillow Chief Economist Svenja Gudell. "In most areas, the market is being driven mainly by a strong labor market and tight supply, especially among entry level homes that first time buyers are after. But some markets—especially the red-hot Pacific Northwest—are adding more jobs and attracting more residents, putting the pressure on home values and rents. The Bay Area and Southern California are still growing at a faster pace than the nation as a whole, but growth rates have come back to earth a bit after several years of rapid growth.”

Separately, Pro Teck Valuation Services released its Home Value Forecast for August—and this month, the trend appears to be favoring an Eastern ascension in home appreciation within the major Core Based Statistical Areas (CSBAs).

"Looking deeper into our ranking shows that out of the 35 CBSAs we label 'hot' in our market condition ranking, 18 of them are from eastern states," said Tom O'Grady, CEO of Pro Teck Valuation Services. "Looking at all seven of our market condition ratings shows that almost 70 percent of the CBSAs we track are in a normal condition or better—further evidence of a broad recovery."

The top markets for home values this month, according to Pro Teck, are Oak Harbor, Wash.; Mount Vernon-Anacortes, Wash.; Visalia-Porterville, Calif.; Durham-Chapel Hill, N.C.; Portland-South Portland, Maine; Silver Spring-Frederick-Rockville, Md.; Charleston-North Charleston, S.C.; Richmond, Va.; Stockton-Lodi, Calif.; and Sacramento-Roseville-Arden-Arcade, Calif. At the other end of the spectrum, the bottom 10 markets on Pro Teck’s list are Huntsville, Ala.; Scranton–Wilkes-Barre–Hazleton, Pa.; Charleston, W.V.; Midland, Texas; Gary, Ind.; Atlantic City–Hammonton, N.J.; Jacksonville, N.C.; Flint, Mich.; Muskegon, Mich.; and Saginaw, Mich.