Home Equity Up, Home Flipping Down

Homeowners with mortgages saw their equity increase by a total of $227 billion from the second quarter to the third quarter, according to new data from CoreLogic. In addition to this 3.1 percent quarter-by-quarter spike, 384,000 borrowers moved out of negative equity, raising the level of homes with positive equity to 93.7 percent of all mortgaged properties, or approximately 47.9 million homes.

CoreLogic is also reporting that home equity grew by $726 billion from the third quarter of 2015 to this year’s third quarter, a 10.8 percent spike. Mortgaged residential properties with negative equity stood at 3.2 million, or 6.3 percent of all homes with a mortgage, down by 10.7 percent quarter-over-quarter and a 24.1 percent year-over-year plummet. The national aggregate value of negative equity was about $282 billion at the end of third quarter, a 0.8 percent drop from the second quarter and 8.2 percent below the third quarter of 2015.

Texas had the highest percentage of homes with positive equity at 98.4 percent, followed by Alaska (98.1 percent), Colorado (97.9 percent), Utah (97.9 percent) and Washington (97.9 percent). Nevada had the highest percentage of mortgaged properties in negative equity at 14.2 percent, followed by Florida (12.5 percent), Illinois (10.6 percent), Arizona (10.6 percent) and Rhode Island (10 percent)—these five states combined accounted for 30.6 percent of negative equity mortgages, but only 16.3 percent of outstanding mortgages. On a metro area measurement, California’s San Francisco-Redwood City-South San Francisco market had the highest percentage positive equity at 99.4 percent, while Florida’s Miami-Miami Beach-Kendall, corridor had the highest percentage of negative equity at 17 percent.

"Price appreciation is the main ingredient for home equity wealth creation, and home prices rose 5.8 percent in the year ending September 2016 according to the CoreLogic Home Price Index," said Anand Nallathambi, president and CEO of CoreLogic. "Paydown of principal is the second key component of equity building. Many homeowners have refinanced into shorter-term loans, such as a 15-year loan, and by doing so, they have significantly fewer mortgage payments and are able to build equity wealth faster."

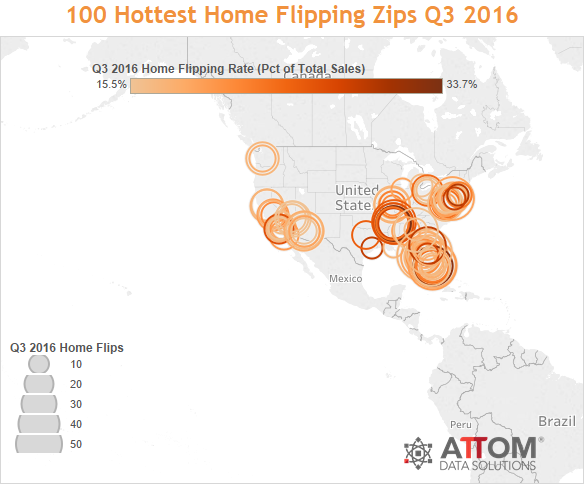

While home equity was on the rise, home flipping was on the decline. ATTOM Data Solutions’ third quarter U.S. Home Flipping Report found 45,718 single family home and condo sales were flips in the third quarter, representing 5.1 percent of all single family and condo sales during the quarter. This is a drop from the 5.6 percent rate in the previous quarter; on a year-over-year measurement, the level was unchanged.

Within the flipped inventory, 67.9 percent were purchased with cash, down from 68.2 percent in the previous quarter and down from 69 from a year earlier. The cash-only transactions were the lowest recorded the third quarter of 2008.

“While the macro trends of low housing inventory and rising home prices are favorable for flippers, they are also a double-edged sword, attracting more competition and reducing the availability of deals—particularly in the most fundamentally sound local markets,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “This is chasing some investors into markets and neighborhoods that may be less fundamentally sound but also offer more value-add opportunities for flippers in the form of aging housing inventory.”