Advertisement

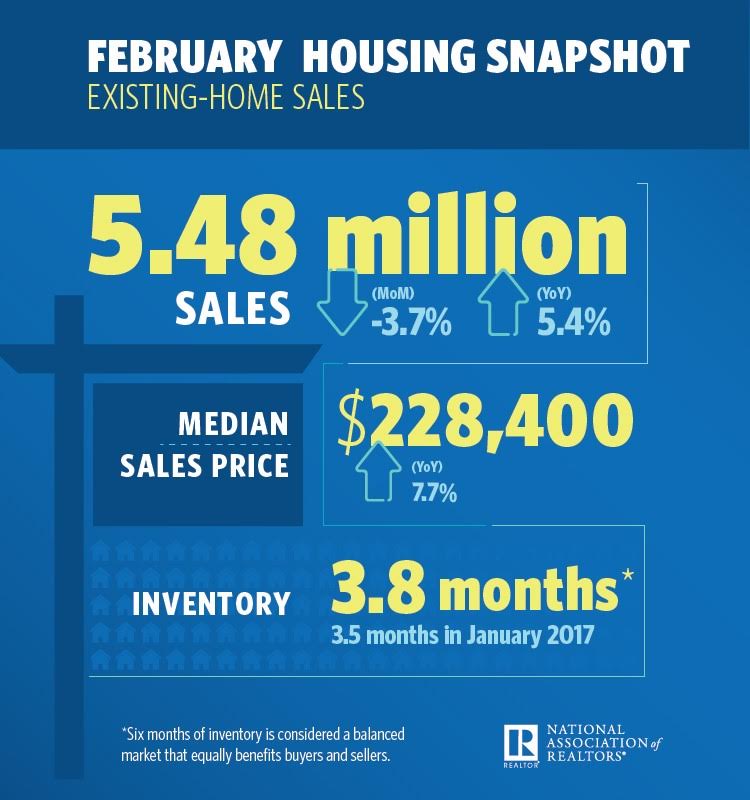

Existing-Home Sales Drop 3.7 Percent

Existing-home sales fell by 3.7 percent to a seasonally adjusted annual rate of 5.48 million in February from 5.69 million in January, according to new data from the National Association of Realtors (NAR). On a year-over-year measurement, however, sales were up by 5.4 percent.

The median existing-home price for all housing types in February was $228,400, up 7.7 percent from the $212,100 level one year earlier. February’s price increase was the greatest year-over-year gain since the 8.1 percent last January, and it marks the 60th consecutive month of year-over-year gains.

Total housing inventory at the end of February increased 4.2 percent to 1.75 million existing homes available for sale, but was 6.4 percent lower than a year ago (1.87 million). February marked the 21st consecutive month that inventory is down on a year-over-year basis. First-time buyers were responsible for 32 percent of sales in February, down from 33 percent in January but up from 30 percent a year ago.

“The affordability constraints holding back renters from buying is a signal to many investors that rental demand will remain solid for the foreseeable future,” said NAR Chief Economist Lawrence Yun. “Investors are still making up an above average share of the market right now despite steadily rising home prices and few distressed properties on the market, and their financial wherewithal to pay in cash gives them a leg-up on the competition against first-time buyers.”

About the author