Advertisement

Homeowners and Appraiser Still Disagree on Property Values

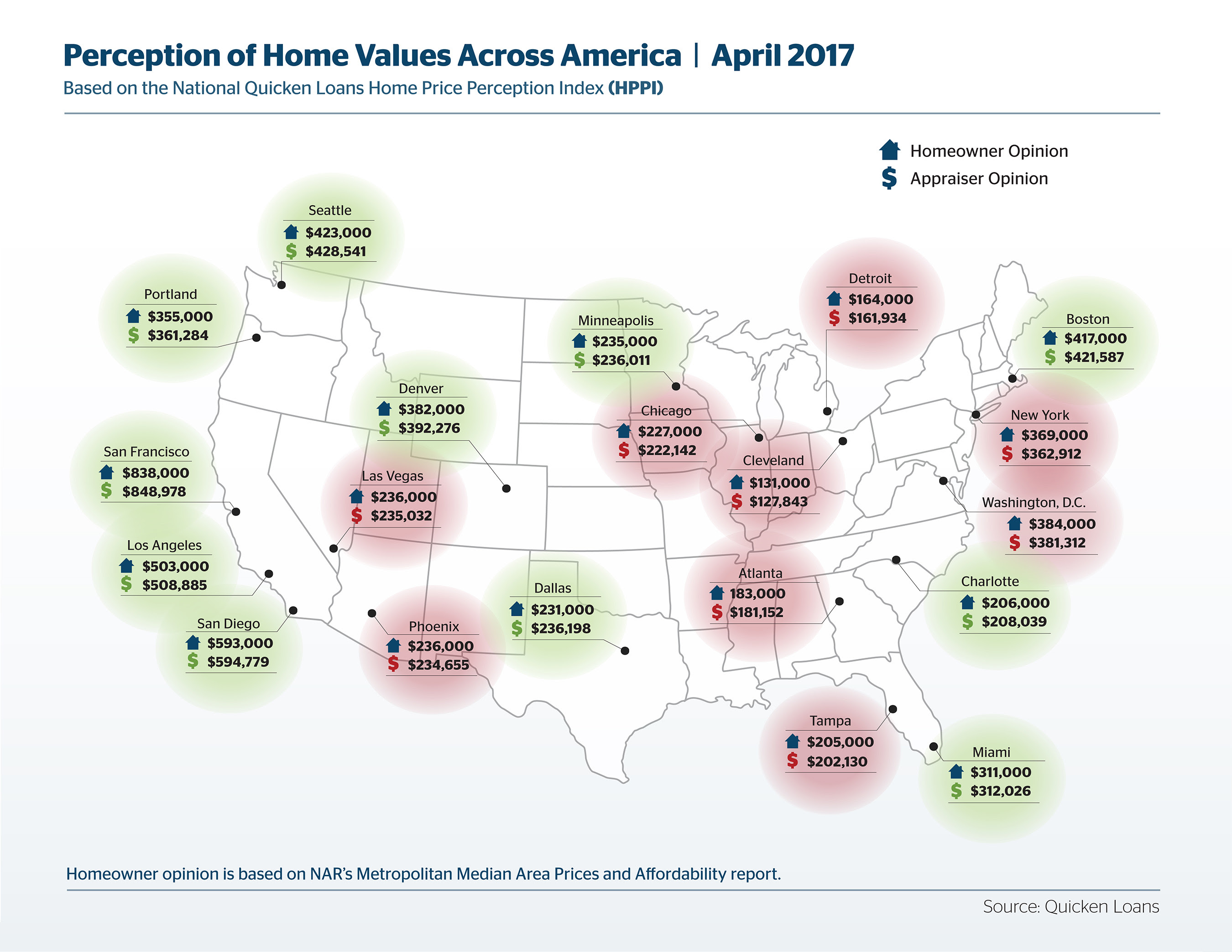

The gap between homeowner and appraiser estimates on the value of residential property became greater, according to new data from Quicken Loans.

During March, average appraisals were 1.77 percent below what homeowners expected. This is the fourth consecutive month that homeowner estimates and appraiser opinions of value became more distant. Meanwhile, appraisals were up by 0.63 percent from February to March and saw a 3.30 percent year-over-year increase.

“The national average shows appraisals lower than homeowner expectations, but some cities are bucking that trend,” said Quicken Loans Vice President of Capital Markets, Bill Banfield. “With prices sprinting forward in many of the booming housing markets in the West, it can be difficult for homeowners to keep up with appraisers, who are on the ground, examining real estate price changes every day. This study is one more reminder for consumers to keep an eye on their local market before selling or refinancing. The state of their local market could affect their home’s value on either end of the spectrum.”

About the author