Advertisement

Mortgage Rates Flat, Credit Availability Slightly Down

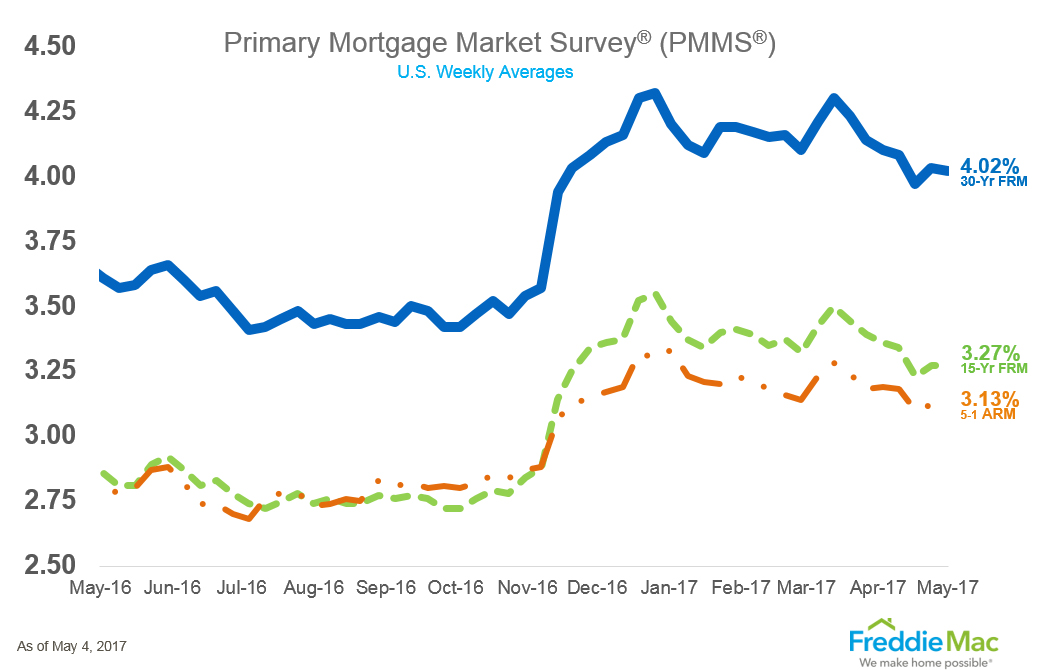

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) saw minimal movement for the week ending May 4.

The 30-year fixed-rate mortgage (FRM) averaged 4.02 percent, down from last week when it averaged 4.03 percent, and the 15-year FRM this week averaged 3.27 percent, the same as last week. A year ago at this time, the 15-year FRM averaged 2.86 percent. But the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.13 percent this week, up from last week’s 3.12 percent average.

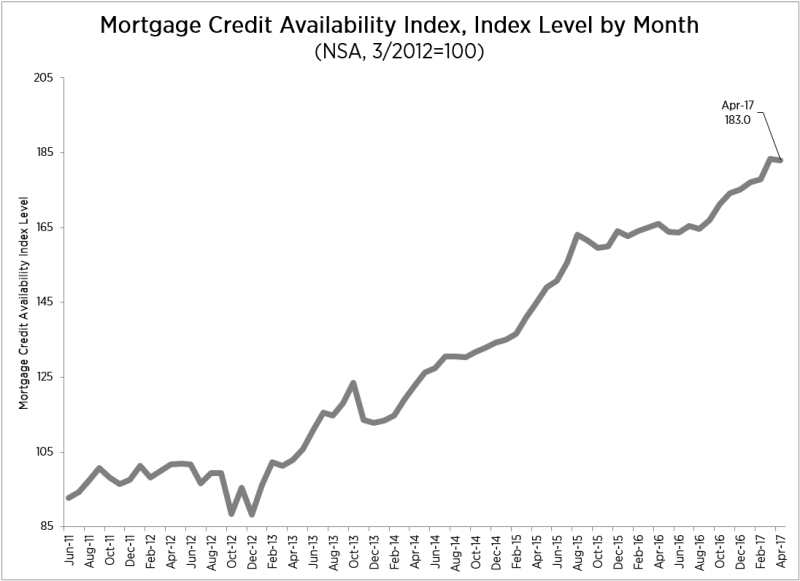

Separately, the Mortgage Bankers Association (MBA) reported that its Mortgage Credit Availability Index (MCAI) dipped by 0.2 percent to 183 in April. Three of the four component indices were down—the Conforming MCAI dropped 0.9 percent, followed by the Conventional MCAI with a 0.6 percent fall and the Jumbo MCAI sliding 0.4 percent—while the Government MCAI was unchanged from last month.

“After some program changes early in the year and some merger activity among investors, credit availability held fairly steady in April with little discernable change in the composition of the supply of credit for government and jumbo programs,” said Lynn Fisher, MBA’s vice president of research and economics. “Conforming credit availability has slipped a bit since the beginning of the year, with fewer program offerings along a range of credit characteristics and no particular culprit.”

About the author