Advertisement

Appraisal Gap Widens in May

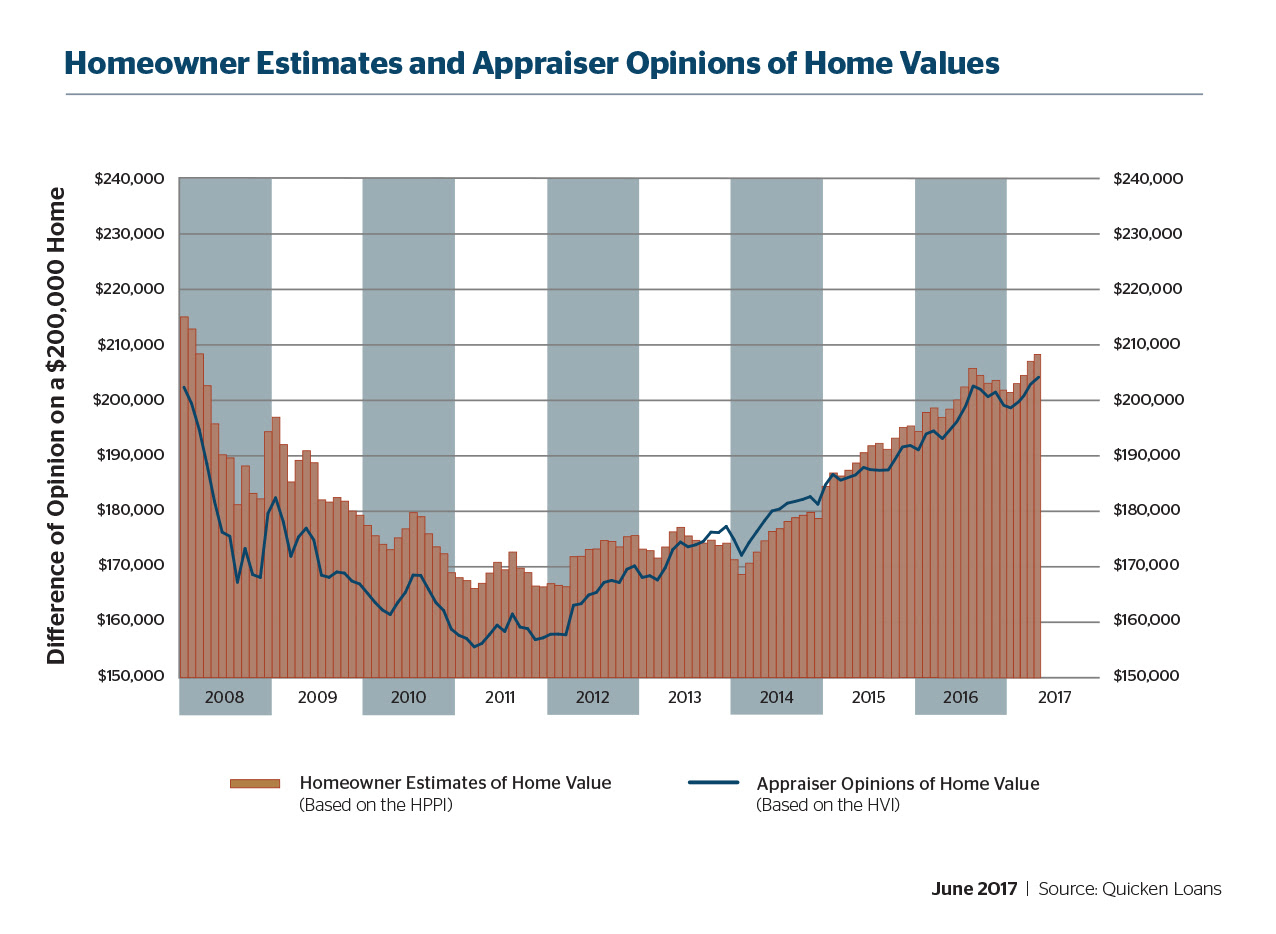

Home values continue to lag owners’ expectations. Appraised values were an average of 1.93 percent lower than what homeowners expected, according to Quicken Loans’ National Home Price Perception Index (HPPI). The gap between estimated value and appraised value, on a national level, continued to widen for a sixth consecutive month.

Appraisals are falling farther from owner estimates, but they are rising higher each month. Home values rose an average of 0.63 percent in May, and increased 4.92 percent year-over-year, as measured by Quicken Loans’ National Home Value Index (HVI).

Appraisals are falling farther from owner estimates, but they are rising higher each month. Home values rose an average of 0.63 percent in May, and increased 4.92 percent year-over-year, as measured by Quicken Loans’ National Home Value Index (HVI).

The Quicken Loans HPPI showed that owners’ home value estimates were an average of 1.93 percent higher than appraisers’ opinions of the value, at a national level. There was a slight widening between the two data points since April, when there was a 1.90 percent difference. May is the sixth month the two valuations moved farther apart. Despite the national average, perceptions varied across the country. In Denver or Dallas appraisals were nearly three percent higher than expected, while in Philadelphia or Baltimore appraised values were more than 3 percent lower than what homeowners estimated.

“It’s important for consumers to see the HPPI and not only think about the difference in perceptions, but the different perceptions across the country, said Bill Banfield, Quicken Loans executive vice president of Capital Markets.

Home values rose at a national level, and in much of the country, according to the Quicken Loans HVI–which measures home value changes based solely on appraisals. Nationally, appraised values increased 0.63 percent from their level in May, and rose 4.92 percent when viewed annually. The Northeast was the only region measured that showed a home value loss, with appraisals dropping 1.63 percent since the previous month. However all four regions had year-over-year gains, ranging from a 1.15 percent increase in the Northeast to a 6.85 percent increase in the West.

“The strong demand for housing paired with the low levels of inventory continue to push values higher,” said Banfield. “Prices are rising as values push higher, making many parts of the country enticing markets for sellers. Many owners will find that they can get more than expected out of their home.”

About the author