Advertisement

Amid Fed Rate Hike, Mortgage Rates Rise

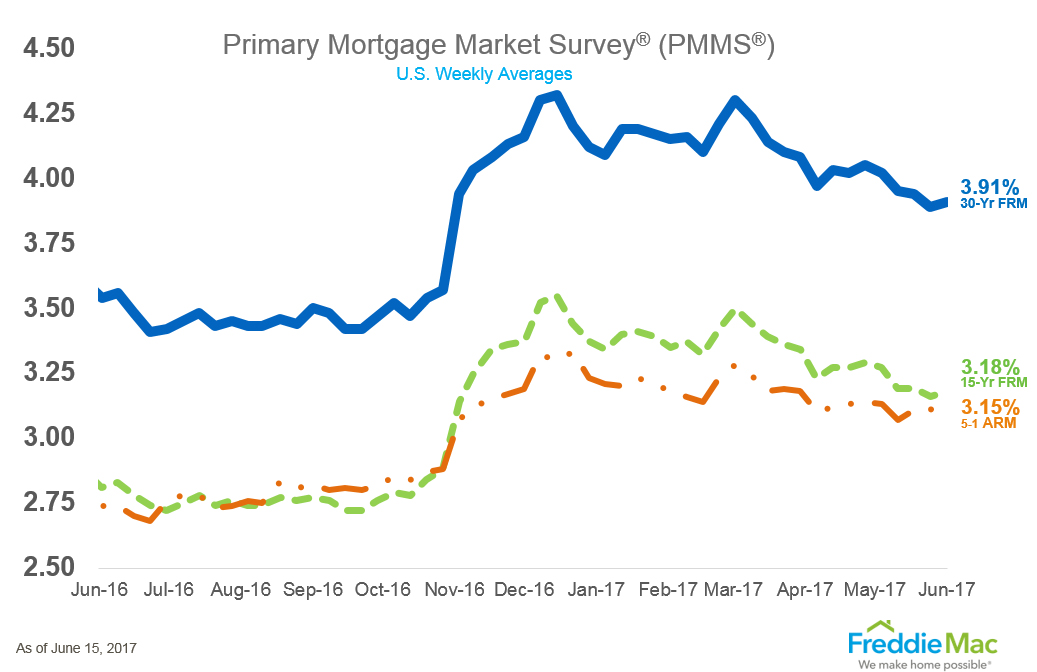

After yesterday’s decision by the Federal Reserve to raise interest rates, Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average mortgage rates increasing across the board for the first time in over a month. The 30-year fixed-rate mortgage (FRM) averaged 3.91 percent, with an average 0.5 point for the week ending June 15, 2017, up from last week when it averaged 3.89 percent. A year ago at this time, the 30-year FRM averaged 3.54 percent.

"The 30-year mortgage rate rose two basis points over the week to 3.91 percent,” said Sean Becketti, chief economist, Freddie Mac. “However, our survey was conducted before investors drove Treasury yields sharply lower in a reaction to the surprisingly weak CPI release. If that drop in yields sticks, mortgage rates are likely to follow in next week's survey."

The 15-year FRM averaged 3.18 percent with an average 0.5 point, up from last week when it averaged 3.16 percent. A year ago at this time, the 15-year FRM averaged 2.81 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.15 percent this week with an average 0.5 point, up from last week when it averaged 3.11 percent. A year ago at this time, the five-year ARM averaged 2.74 percent.

About the author