Advertisement

Less Than One-Third of Millennials Are Homeowners

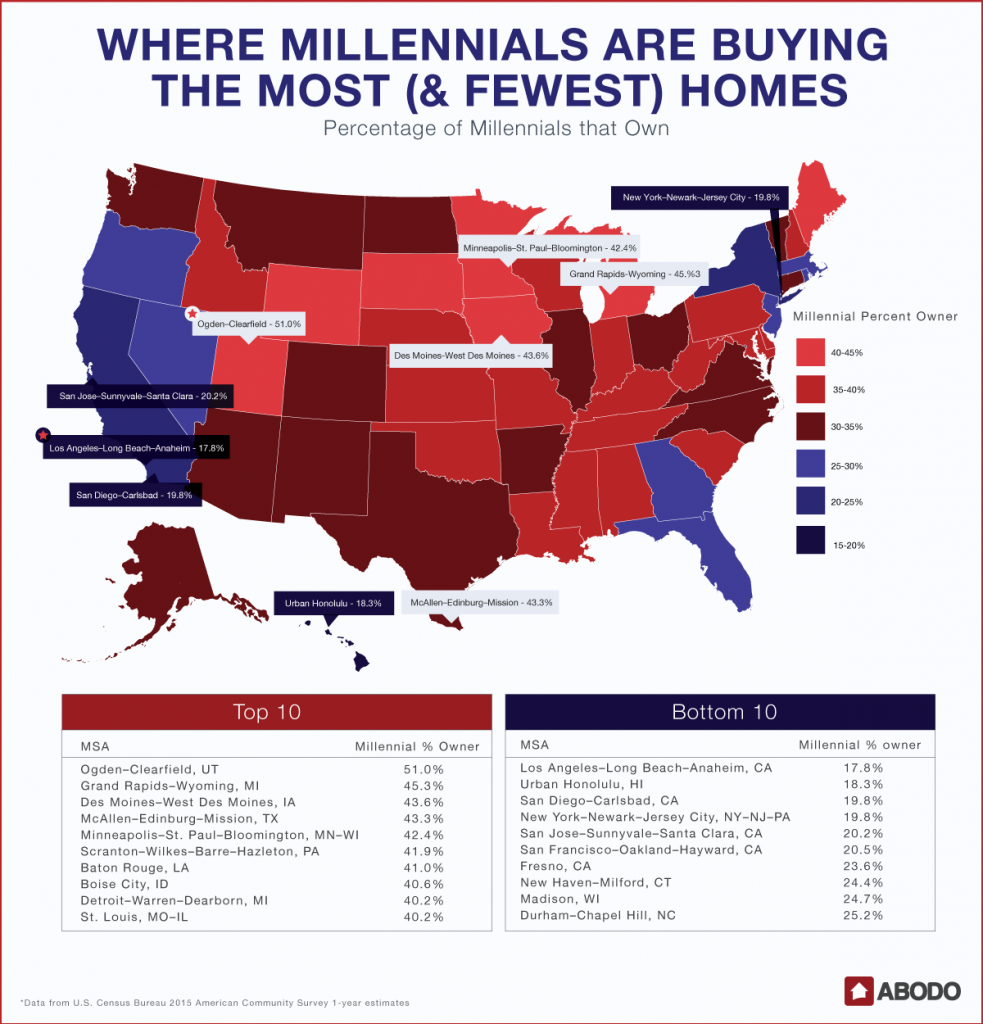

Less than one-third of Millennials are homeowners, but the homeownership rates among this youthful demographic are significantly lower in expensive coastal cities and pricey college towns, according to a new data analysis from ABODO.

On a national level, 32.1 percent of Millennials are homeowners—back in 2005, the number was 39.5 percent—but those numbers vary among markets. Among the metro areas with higher-than-average Millennial homeownership rates are Ogden–Clearfield, Utah, where 51 percent of Millennials own homes, followed by the Grand Rapids, Mich., metro area (45.3 percent), Des Moines-West Des Moines, Iowa (43.6 percent), the McAllen, Texas, metro (43.3 percent) and Minneapolis-St. Paul (42 percent). ABODO noted that all of these markets are small to-midsize cities in the Midwest, South, and Southwest.

However, Millennial homeownership rates are much smaller in major coastal markets: California’s Los Angeles–Long Beach–Anaheim has a 17.8 percent Millennial homeownership rate, the lowest in the country. Other low percentages are in Urban Honolulu (18.3 percent), California’s San Diego–Carlsbad corridor and the New York–Newark–Jersey City metro area, both at a 19.8 percent level.

Metro areas with a large college student population are also lacking in Millennial homeowners: Connecticut’s New Haven–Milford metro (24.4 percent), Madison, Wis. (24.7 percent) and Durham–Chapel Hill, N.C. (25.2 percent) have disproportionately high percentages of college-age Millennials relying on renting or dorm life.

About the author