Advertisement

Buy or Rent? It Depends Where You Live

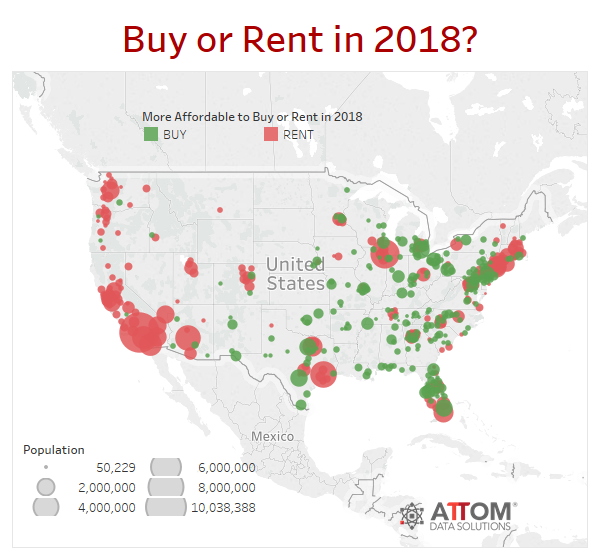

Buying a home is more affordable than renting in more than half of the nation’s housing markets, but nearly two-thirds of the population live in the markets where it more affordable to rent than buy. However, buyers are increasingly finding themselves paying more than the list price for the properties they want.

According to analysis of 447 counties by ATTOM Data Solutions, buying a median-priced home is more affordable than renting a three-bedroom property in 240 counties, or 54 percent of the total housing markets. However, renting is more affordable than buying a home in the 14 most populated counties and in 30 of 39 counties with a population of one million or more. This includes some of the most expensive markets, including the San Jose, Seattle, San Francisco and New York City metro areas, as well as California’s Los Angeles and San Diego Counties.

“Although buying is still more affordable than renting in the majority of U.S. housing markets, that majority is shrinking as home price appreciation continues to outpace rental growth in most areas,” said Daren Blomquist, Vice President at ATTOM Data Solutions. “Renting has clearly become the lesser of two housing affordability evils in many major population centers, with renting more affordable than buying in 76 percent of counties that have a population of 1 million or more. And when broken down by population rather than number of markets, this data shows that the majority of the U.S. population—64 percent—live in markets that are more affordable to rent than to buy.”

Further complicating matters is another data report that determined homebuyers paid more than the asking price in 24 percent of home sales last year. Zillow is reporting that sellers snagged an average of $7,000 above their asking price. Five years ago, 17.8 percent of final sale prices were higher than the asking price.

In some markets, the asking price is routinely jettisoned during the homebuying process. More than half of the homes sold last year in San Jose, San Francisco, Salt Lake City and Seattle went for above the list price—with San Jose sellers harvesting an additional $62,000, the largest difference between list and sale price of the metro areas analyzed by Zillow.

"Low interest rates and strong labor markets with high-paying jobs have allowed home buyers in some of the country's priciest housing markets to bid well over asking price," said Zillow Senior Economist Aaron Terrazas. "In the booming tech capitals of the California Bay Area and Pacific Northwest, paying above list price is now the norm. In the face of historically tight inventory, buyers have had to be more aggressive in their offers. We don't expect this inventory crunch to ease meaningfully in 2018, meaning buyers will be facing many of the same struggles this year."

About the author