Advertisement

Mortgage Rates and Applications Are Up

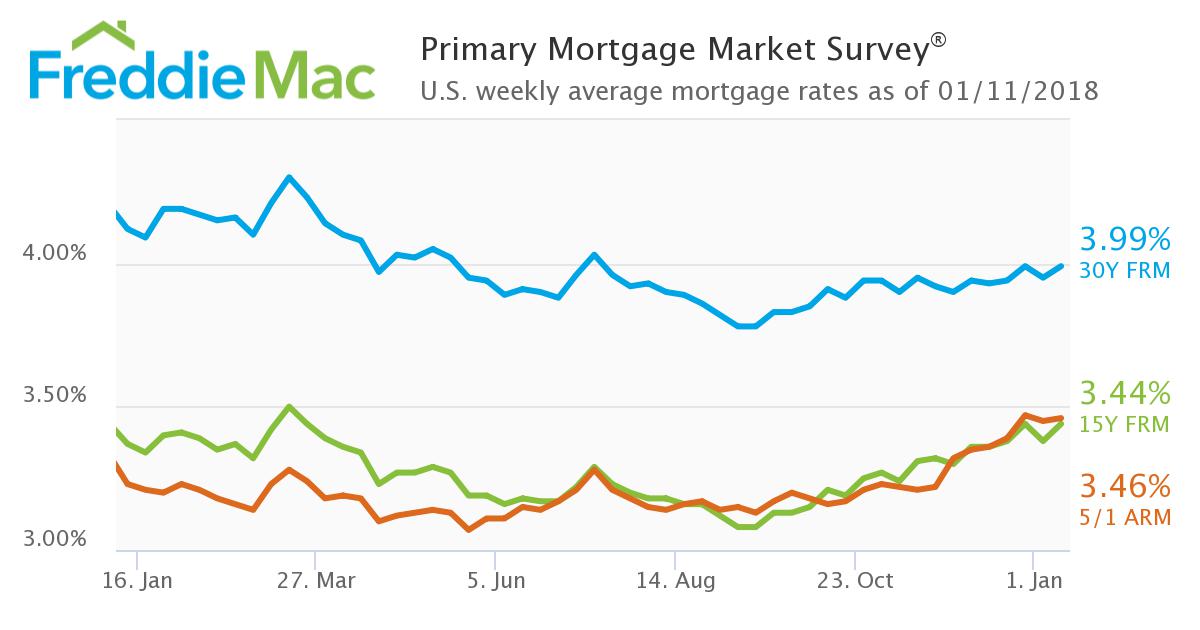

Average mortgage rates are on the rise again, according to Freddie Mac’s latest Primary Mortgage Market Survey (PMMS).

The 30-year fixed-rate mortgage (FRM) averaged 3.99 percent for the week ending Jan. 11, up from last week when it averaged 3.95 percent. The 15-year FRM this week averaged 3.44 percent, up from last week when it averaged 3.38 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.46 percent this week, up from last week when it averaged 3.45 percent.

Separately, the Mortgage Bankers Association (MBA) Builder Applications Survey (BAS) data for December found a 7.8 percent year-over-year increase in mortgage applications for new home purchases. Compared to November, however, last month saw an 18 percent drop in activity.

The MBA estimated new single-family home sales were running at a seasonally adjusted annual rate of 554,000 units in December, down by 16.4 percent from the November pace of 663,000 units. On an unadjusted basis, the MBA estimated that there were 40,000 new home sales in December, a 14.9 percent drop from 47,000 new home sales in November. Nonetheless, the average loan size of new homes increased from $337,427 in November to $339,203 in December, and 72.5 percent of applications involved conventional home loans while 15.1 percent were FHA loans and 10.1 percent were VA loans.

“After playing catch-up for two months following the slowdown caused by hurricanes Harvey, Irma and Maria, mortgage applications for new homes declined in December to a more normal growth rate of 7.8 percent on a year over year basis,” said MBA Vice President of Research and Economics Lynn Fisher. “Looking at all of 2017, applications increased by 7.1 percent compared to 2016. Based on December applications, we forecast that new home sales fell in December but remained nearly 16 percent higher than a year ago, and we are anticipating only modest year over year growth for new home sales in 2018. Despite robust demand, a lack of labor and land will continue to constrain homebuilders.”

About the author