Advertisement

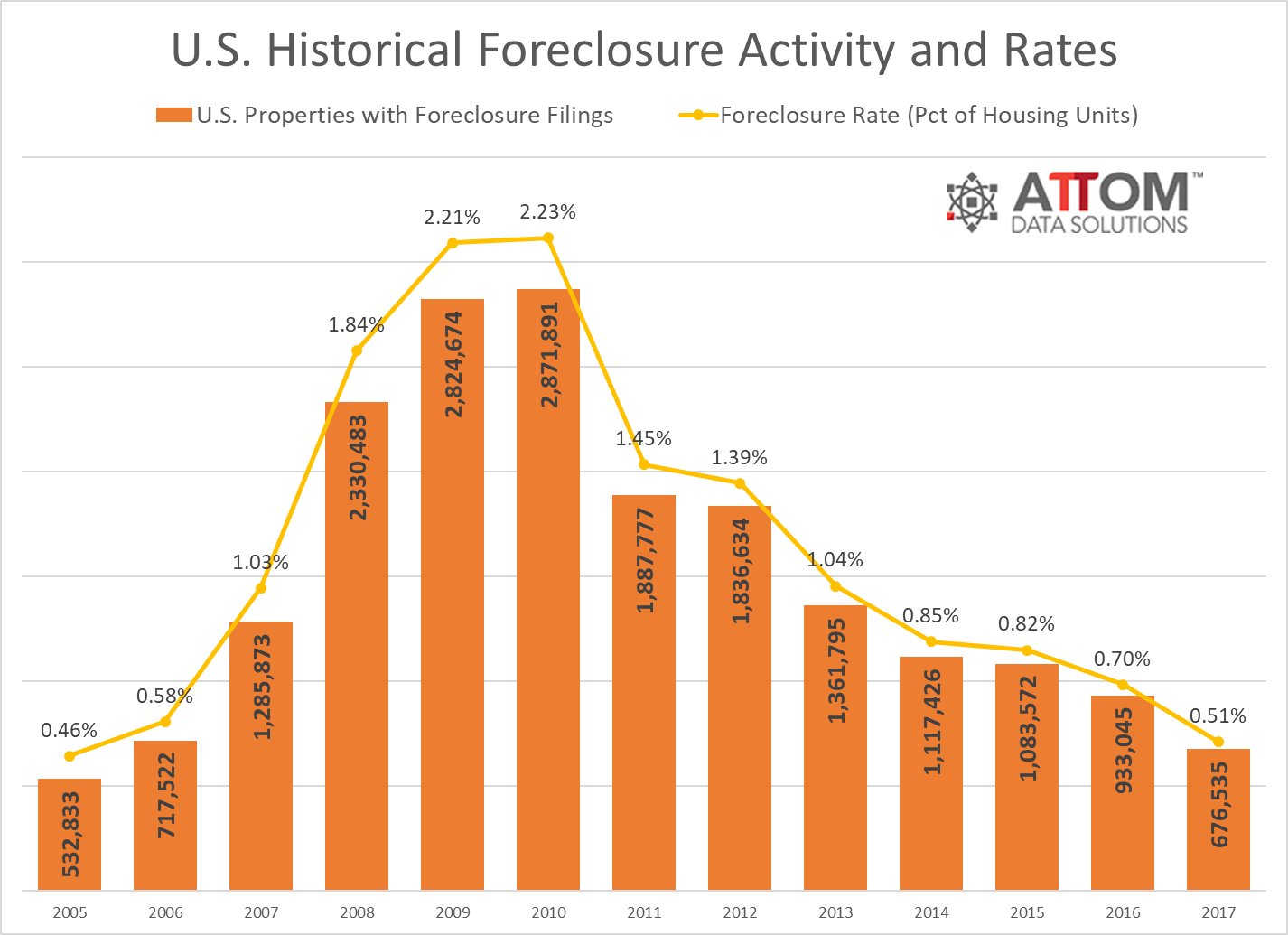

Foreclosure Activity in 2017 Hits 12-Year Low

Foreclosure filings were reported on 676,535 residential properties in 2017, down 27 percent from 2016. The properties with foreclosure filings represented 0.51 percent of all housing units, down from 0.70 percent in 2016. Last year’s foreclosure activity was a dramatic 76 percent plummet from a peak of nearly 2.9 million in 2010 and represented the lowest recorded level since 2005.

However, year-over-year increases in foreclosure starts in 2017 were posted in five states and the District of Columbia, while seven states and the District of Columbia posted a year-over-year increase in scheduled foreclosure auctions. Two New Jersey cities had the highest foreclosure rates among major metro areas: Atlantic City (2.72 percent of housing units with a foreclosure filing) and Trenton (1.68 percent).

During December, when there were 64,651 properties with foreclosure filings, up 1 percent from the previous month but 25 percent lower on a year-over-year basis. December marked the 27th consecutive month with a year-over-year decrease in foreclosure activity.

“Thanks to a housing boom driven primarily by a scarcity of supply, which has helped to limit home purchases to the most highly qualified—and low-risk—borrowers, the U.S. housing market has the luxury of playing a version of foreclosure limbo in which it searches for how low foreclosures can go,” said Daren Blomquist, Senior Vice President at ATTOM Data Solutions. “There are a few notable local market exceptions playing a different version of foreclosure limbo in which a backlog of legacy foreclosure activity left over from the last housing crisis is still winding its way through a labyrinthine foreclosure process, resulting in incongruous jumps in various stages of foreclosure activity in markets such as New York, New Jersey and D.C.”

About the author