Advertisement

Mortgage Rates Drop, Home Prices Rise

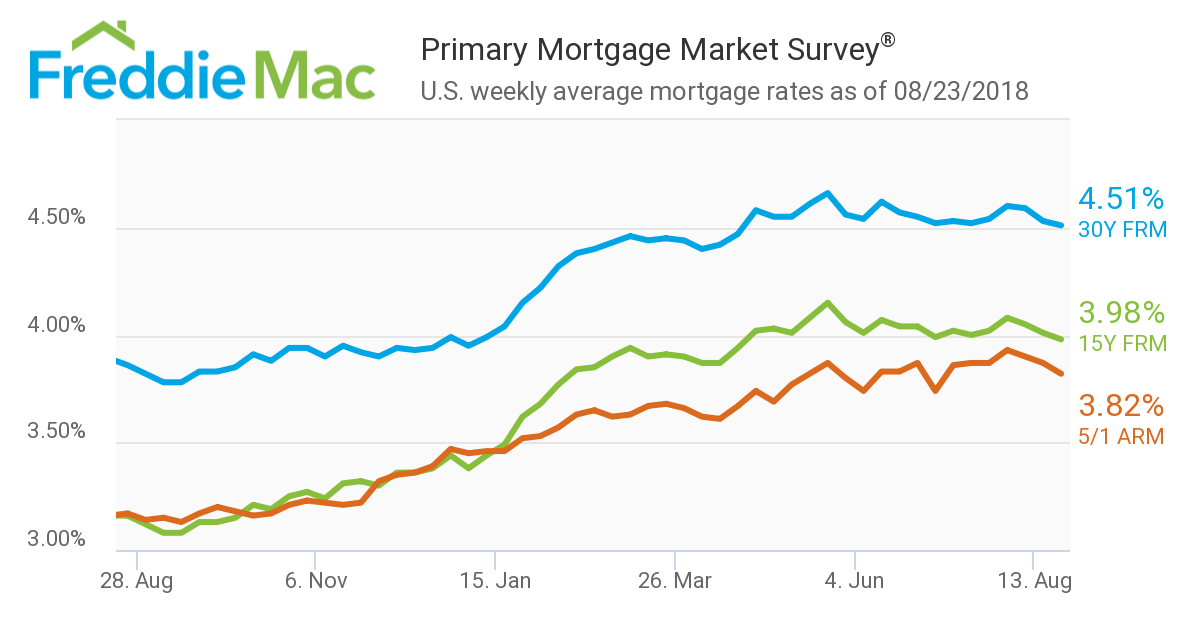

Mortgage rates were on the decline for the third consecutive week, according to new data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.51 percent for the week ending Aug. 23, down from last week when it averaged 4.53 percent. The 15-year FRM this week averaged 3.98 percent, down from last week when it averaged 4.01 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.82 percent, down from last week when it with an average 3.87 percent.

“It is clear affordability constraints have cooled the housing market, especially in expensive coastal markets,” said Sam Khater, Freddie Mac’s Chief Economist. “Many metro areas desperately need more new and existing affordable inventory to break out of this slump.”

Separately, the Federal Housing Finance Agency (FHFA) reported a 1.1 percent second quarter increase in home prices during the second quarter. On an annualized basis, prices were up by 6.5 percent, with the greatest increases in Nevada (up 17 percent), Idaho (up 13 percent) and the District of Columbia (up 11.8 percent). North Dakota had the lowest year-over-year home price increase, up 2.1 percent.

But while home prices are up, home value growth is showing signs of cooling down. Zillow is reporting that annual home value growth during July showed in 20 of the nation’s 35 largest housing markets. Seattle, which was the leader in home value growth one year ago, is now the 12th fastest-appreciating housing market with a nine percent appreciation rate—last year at this time, the rate was 14 percent.

"The nation's pricier markets are starting to feel an affordability squeeze as buyers begin to balk at the sustained, rapid rise in prices that have followed the strong job growth and high housing demand of the past half-decade," said Zillow Senior Economist Aaron Terrazas. "But despite the slowdown, home values are still growing faster than their historic pace in almost all large markets, and it's far too soon to call it a buyer's market. And in many of the nation's more affordable areas, aside from the pricey and exclusive San Francisco Bay Area, home value growth has perked up as buyers continue to seek good value for their money. But it's clear that the winds that have boosted sellers over the past few years are ever-so-slightly starting to shift."

In other data news, the U.S. Census Bureau and the Department of Housing and Urban Development reported that sales of new single-family houses in July were at a seasonally adjusted annual rate of 627,000, which is 1.7 percent below the revised June rate of 638,000 and 12.8 percent above the July 2017 estimate of 556,000. The median sales price of new houses sold in July was $328,700 and the average sales price was $394,300. The seasonally-adjusted estimate of new houses for sale at the end of July was 309,000, which represents a supply of 5.9 months at the current sales rate.

About the author