Advertisement

Mortgage Rates Rise Slightly

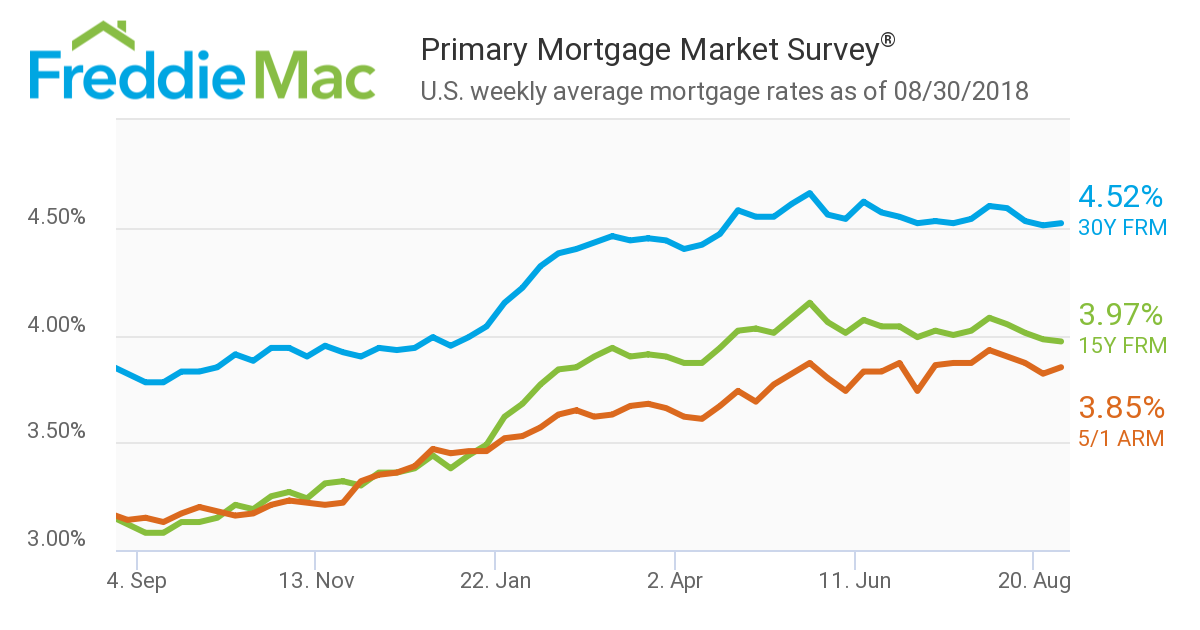

Mortgage rates inched up this past week, according to new data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.52 percent for the week ending Aug. 30, up from last week when it averaged 4.51 percent. The 15-year FRM this week averaged 3.97 percent, down from last week when it averaged 3.98 percent. And the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.85 percent, up from last week when it averaged 3.82 percent.

“The 30-year fixed-rate mortgage barely inched up this week, continuing the summer trend of essentially being flat,” said Sam Khater, Freddie Mac’s chief economist. “While sales and price growth have softened these last few months, this leveling of rates may be helping more buyers reach the market. Purchase mortgage applications this week were once again modestly above year ago levels. Given the strength of the economy, it is possible for home sales to pick up even more before year’s end. The key factor will be if affordably-priced inventory increases enough to continue this recent trend of cooling price appreciation.”

About the author