Advertisement

Survey Finds Student Loan Debt and Affordability Block Homebuyers

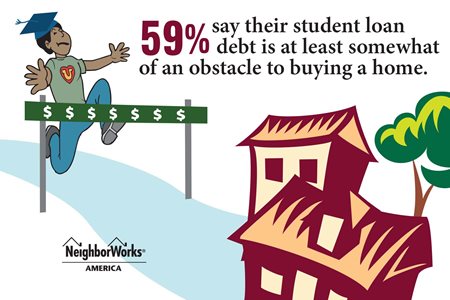

Student loan debt and the lack of affordable options are keeping many potential buyers from pursuing homeownership, according to NeighborWorks America’s sixth annual national housing survey.

Although 92 percent of survey respondents said homeownership was an important part of the American Dream, student debt is preventing many younger Americans from turning the dream into reality. Thirty-six percent of respondents said they knew someone who delayed the purchase of a home because of student loan debt, while 59 percent of Millennials acknowledged knowing someone who delayed buying a home for that reason.

Although most respondents identified homeownership as a key tenet of financial stability—80 percent of all respondents and 68 percent of Millennials answered affirmatively—affordability was still a concern. Only 44 percent of respondents believes that where they live is affordable for first-time homebuyers, while 62 percent complained that rent prices are too high for the average person to save to buy a home in their area. Among nonwhites, 65 percent said rent prices were too high in their communities.

About the author