Advertisement

Home-Flipping Activity Sinks in Q3

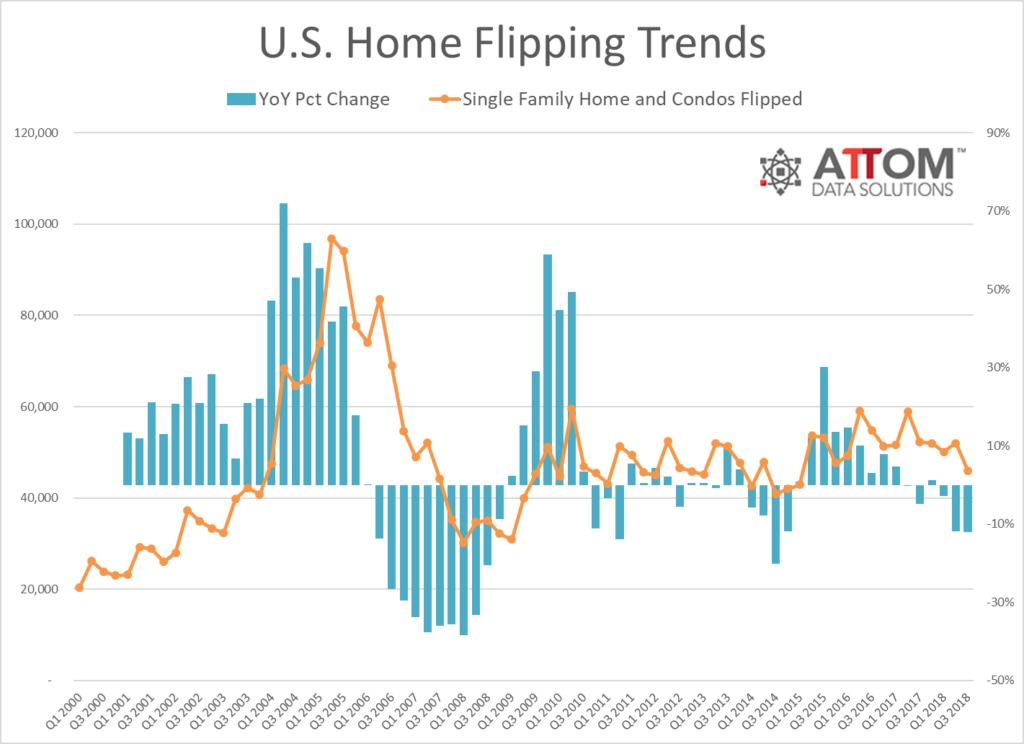

Home flipping activity hit a 3.5-year low during the third quarter, according to new statistics from ATTOM Data Solutions.

During the third quarter, a total of 45,901 single-family homes and condos were flipped, down 12 percent from a year ago to the lowest level since the first quarter of 2015. The flipped properties accounted for five percent of all single-family home and condo sales during the third quarter, down from a 5.2 percent home flipping rate in the previous quarter and down from a 5.1 percent home flipping rate one year earlier. This marked the lowest level recorded since the third quarter of 2016.

Homes flipped in third quarter sold for an average of $63,000 more than what the home flipper paid for them, down from an average gross flipping profit of $65,000 a year ago. This marked the lowest level recorded since the second quarter of 2016. The average gross flipping profit in the third quarter was $63,000, an average 42.6 percent gross flipping return on investment, down from an average 44.1 percent in the previous quarter and down from an average 48.1 percent one year earlier. This was the lowest level recorded since the first quarter of 2012—a 6.5-year low.

Arizona had the highest third quarter home flipping rate among the states (7.7 percent), followed by Tennessee (7.5 percent), Nevada (7.2 percent), Alabama (6.6 percent), and Maryland (six percent). Among 133 major metropolitan areas with at least 50 flips in the third quarter, Memphis had the highest rate at 10.4 percent, followed by Atlantic City at 9.1 percent.

“Home flipping acts as a canary in the coal mine for a cooling housing market because the high velocity of transactions provides home flippers with some of the best and most real-time data on how the market is trending,” said Daren Blomquist, Senior Vice President at ATTOM Data Solutions. “We’ve now seen three consecutive quarters with year-over-year decreases in home flips. The last time that happened was in 2014 following the mortgage rate jump in the second half of 2013, but it’s still far from the 11 consecutive quarters with year-over-year decreases in home flips extending from the second quarter of 2006 through the fourth quarter of 2008 and leading up to the last housing crash.”

About the author