Advertisement

Valuation Perception Gap Widens in November

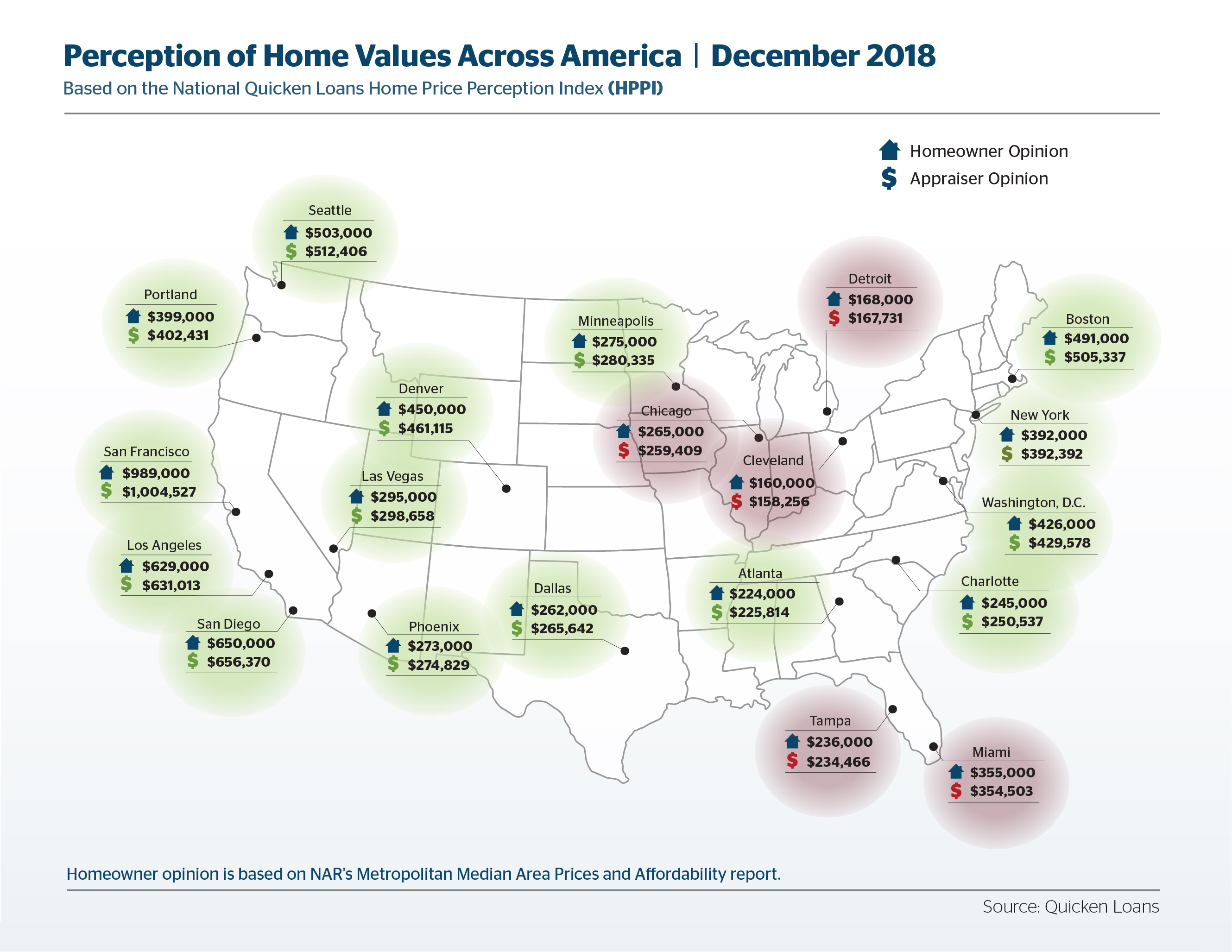

The gap between how homeowners and appraisers view residential values widened slightly in November, according to new data from Quicken Loans.

Appraised values were an average of 0.36 percent lower than what homeowners expected, according to Quicken Loans' National Home Price Perception Index (HPPI). Last month, the HPPI showed appraised values were an average of 0.28 percent lower than owners expected.

Quicken Loans' National Home Value Index recorded a 0.53 percent increase last month while the national average for a home appraisal was 5.01 percent higher than it was in November 2017.

"Homeowner perception staying at a steady level is a sign of a sturdy housing market," said Bill Banfield, Quicken Loans Executive Vice President of Capital Markets. "Some homeowners may not be as aware of home value changes as the professionals who study the real estate market every day, so any large, sudden, spikes or drops in home values, are often reflected by a swift widening gap in the HPPI."

About the author